Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Amy Xie Patrick: Outlook from the bond enthusiast

This article is more than 12 months old. Find our latest insights here

What are the main factors now affecting fixed income investors? Pendal’s head of income strategies AMY XIE PATRICK explains how her view has evolved in recent months

- There could be heightened volatility and bouts of “everything sell-offs”

- A hard landing isn’t off the table, but it’s too soon to position for it yet

- Why bonds, why now? Pendal’s income and fixed interest experts explain

- Browse Pendal’s fixed interest funds

Will US 10-year yields end the year closer to 3% or 5%?

Three months ago, I would have put a 70% probability on 3%.

Today, I’m a fence-sitter – though there are arguments for both sides of the fence.

The main thing that’s changed is…well…nothing. The consumer is still incredibly resilient. It’s not clear where that resilience is coming from, but here’s a theory.

Excess savings buffers have been wearing down since the pandemic, but one thing after another has offset the economic effect.

In 2023, an increasing budget deficit found its way into the pockets of US consumers. In Australia, an influx of immigration kept aggregate consumption at a healthy level, even if individually we were feeling more mixed.

The latest saving grace has been disinflation.

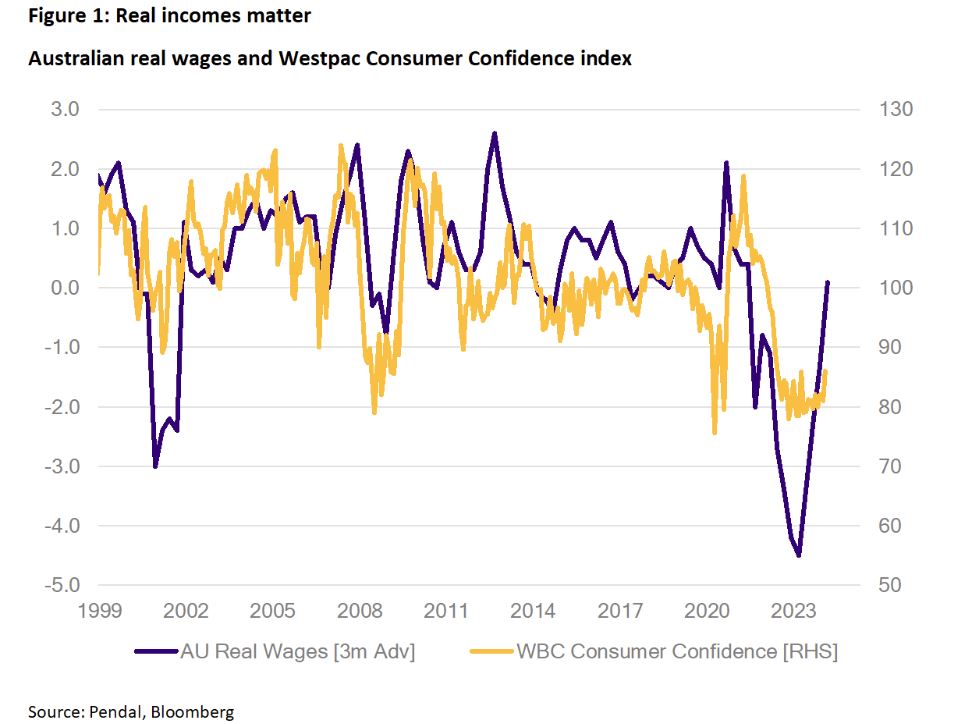

Prices move faster than wages on the way up and on the way down. Put another way, real incomes are eroded in periods of high inflation, and boosted when inflation falls.

This has a direct impact on consumer sentiment, which feeds into consumption.

In Australia there is a strong relationship between real incomes and sentiment. Real wages seem to lead sentiment by about three months.

Even as savings buffers wane, a fall in inflation has boosted real consumer spending power.

Disinflation is no longer enough

Ironically, falling inflation has been my main reason for liking bonds over the past six months.

Big moves lower in bond yields in the fourth quarter of 2023 seemed like vindication for those views.

But as Pendal’s income and fixed interest team watched the data roll in over December and January, we realised disinflation alone would not be enough to justify a large gap between the market’s pricing and the Fed’s dots.

By the end of 2023, interest rate markets had priced in more than seven rate cuts from the Fed in 2024. Though the median of the Fed’s projections saw only three cuts.

Implicit in my previous view was an assumption that falling inflation would be accompanied by a slowing economy.

As labour markets loosened, consumption would also slow to reflect greater uncertainty on jobs.

If such a macro picture was to play out in the data (and it still might), the Fed and other central banks would be able to lower rates more concertedly.

They wouldn’t need to worry about a rebound in inflation because the gravitational forces of slowing demand would be there to help.

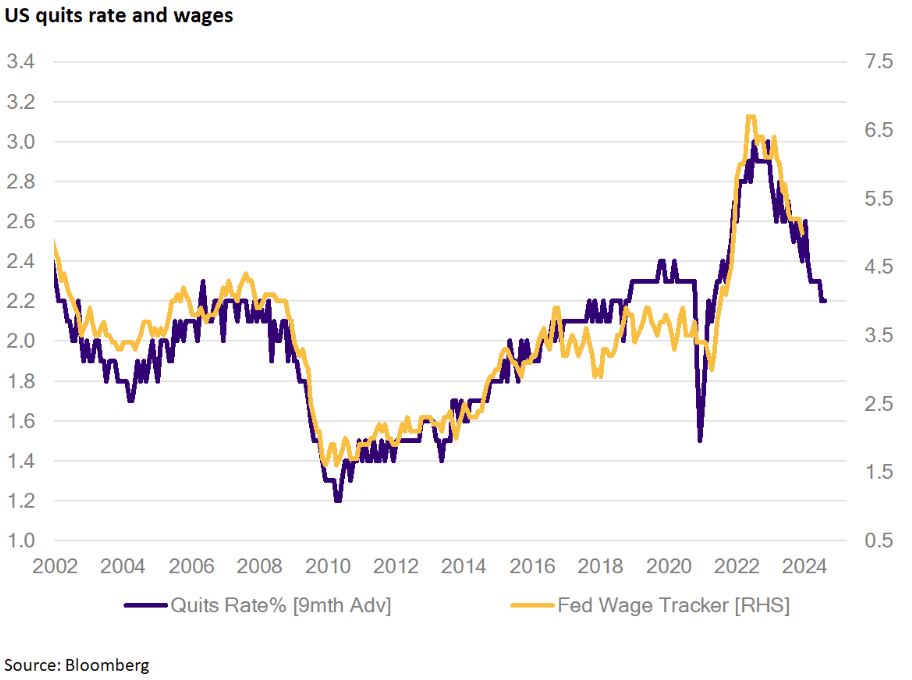

As Figure 2 shows, the disinflation thesis is still intact.

There has been a long-held relationship between the quits rate and wages.

The reasoning is fairly intuitive: we feel less bold about quitting when the prospects of other jobs decline. Empirically, the quits rate seems to lead wage growth by around three quarters.

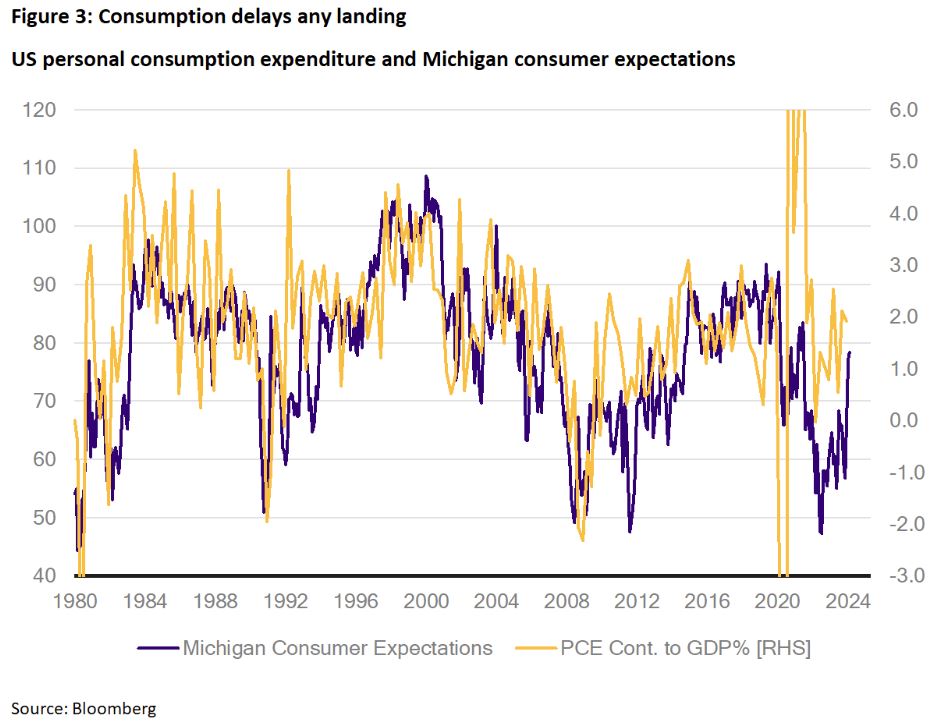

The data for US consumption tells a different story, which throws a spanner in the works for bond enthusiasts.

Personal consumption expenditure (or PCE) turned a corner in 2023 and remains robust.

Consumer sentiment is rebounding more sharply because real incomes are rising.

Since consumption counts for about 70% of US GDP, it’s hard to build a case that the economy is faltering just yet.

What if there is no landing?

Consumption is now so resilient it’s got the market questioning whether there will be any landing, let alone a hard landing.

In the US, it’s not just consumption.

Manufacturing seems to be stabilising, housing has turned a corner, and the fiscal drag is barely noticeable. Could the next move from the Fed be a hike?

I’m not yet ready to get quite so carried away, but I concede that it’s simply too early to start positioning uber-defensively in portfolios.

Regardless of whether I agree with the no-landing narrative, good portfolio management requires me to entertain that scenario and consider the ramifications for investment decisions.

A no-landing scenario would imply we’ve already moved past any mid-cycle slowdown.

It would support equity analyst earnings growth estimates of around 7.5% this year for the S&P 500 index.

It would give comfort to the idea that high-yield credit spreads can stay lower than what should be implied by recent rising default rates because the worst is already over.

It would also challenge the market and the Fed’s current thinking on rate cuts for this year.

In fact, some argue that if the US economy is still managing to grow above trend with a 5.5% Fed Funds rate, then monetary policy isn’t all that restrictive.

Taken to its conclusion, this train of thought poses risks to bonds.

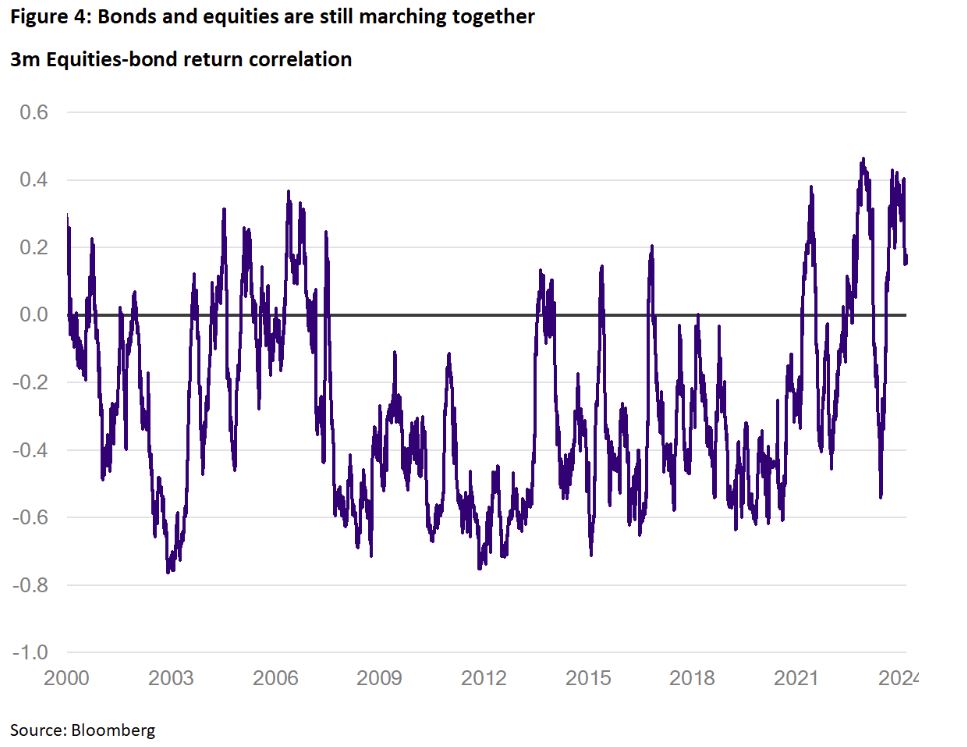

Since bond and equity returns have been positively correlated since late-2022 – excluding the Silicon Valley Bank blip last year – the idea of no-landing also poses a threat to risky assets.

Volatility is an opportunity

As I entertain the possibility of a no-landing scenario, at least for 2024, I am drawn to a few investment implications.

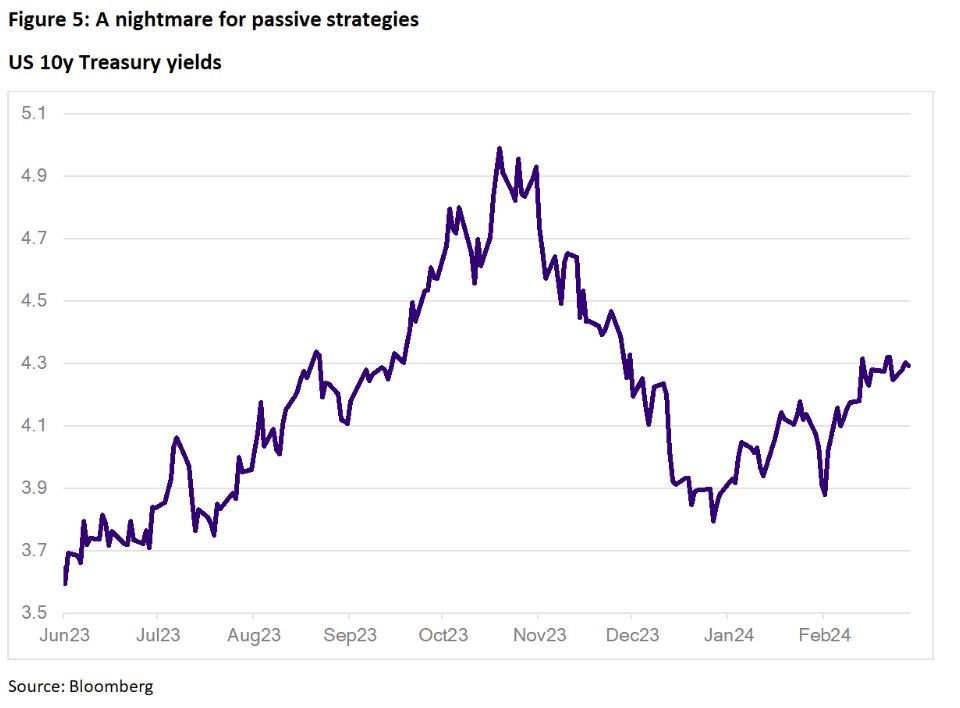

The first is that I need to be truly active on duration this year.

Set-and-forget on bonds won’t work. Our income strategies carried over five years of duration at the end of 2023, which is more than the AusBond Composite Index (Australia’s most popular fixed income benchmark).

Roughly speaking, that translates to a 5% performance move for the portfolio for every 1% move in yields.

Today, these portfolios carry less than one-tenth of that exposure (so nearly no duration at all).

Not only did this help our funds benefit from the strong moves lower in global bond yields at the end of 2023, but also helped us to avoid the decent back-up in yields since the start of 2024.

The second is that I should expect flashbacks to 2022, where almost everything sold off together.

The main driver will come from bonds and knock-on to other asset classes.

Since our income funds can only be long or square in risky assets, maintaining a liquid portfolio so that we can de-risk out of the riskiest pieces quickly will count for a lot in that environment.

The third is that it’s too soon to get uber-defensive.

Investment grade credit is still a good place to stay in risk while avoiding over-extension.

Bringing this allocation down too much and too soon may mean leaving good quality returns on the table.

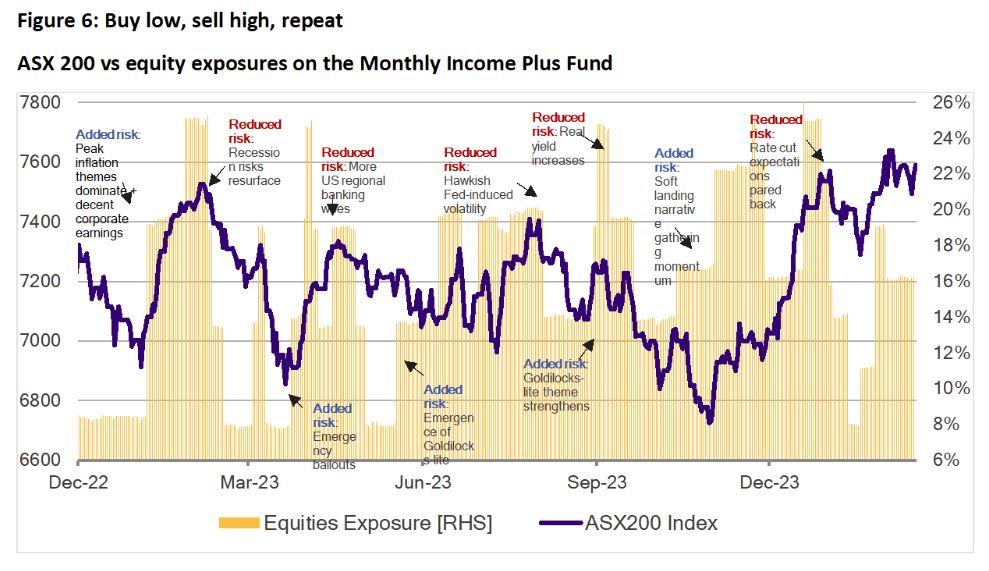

On top of that, I need to remain open to buying opportunities in riskier assets such as equities.

After all, the ASX 200 was largely directionless and volatile until the back end of 2023, yet our Monthly Income Plus portfolio was able to seize on the opportunities afforded by the volatility.

Hard landing is not off the table

While I am not ready to buy-in to the no-landing camp, I acknowledge data now supports that narrative.

Having a plan for how to navigate a no-landing market environment is key. Having the flexibility to enact that plan is vital. Portfolio liquidity will be very important this year.

It is worth stressing that a hard landing isn’t off the table.

Just as my subjective odds for a no-landing scenario in 2024 has increased, the odds I assign to a hard landing has diminished.

It is probably just as likely to happen in the first half of 2025 as in the second half of 2024.

How we get there will be one of two ways.

The first would be something that looks like a soft landing, but carries on softening.

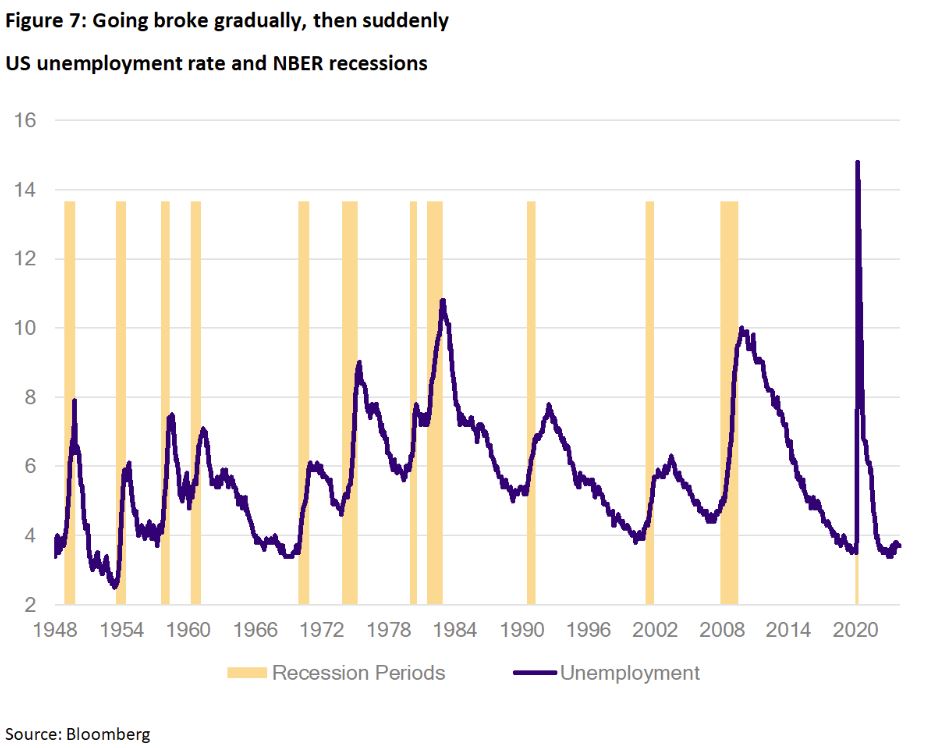

Historical experiences of recessions tells us that it happens gradually, then suddenly (to paraphrase Hemingway).

The explanation for this is not unanimously agreed upon, but it probably has something to do with how hard it is to find a neutral policy point when the economy is at full capacity or full employment.

When the economy is at full employment every extra bit of demand pushes prices higher, causing inflation to soar. Any weakening in demand creates extra capacity and the potential for layoffs as companies cut costs.

The trickiest bit to all of this is knowing that monetary policy hits the economy with a lag, but not knowing how long that lag really is.

The safest bet for central bankers with price stability in their mandates is to err on the side of caution, over-tighten to get inflation under control, and hope they can ease policy in time to avoid a really hard landing.

The track record on that last bit hasn’t been great, though.

This cycle poses extra challenges in figuring out the lags.

Did the post-pandemic fiscal stimulus lengthen the lags? Has a largely fixed-rate US mortgage market dampened the pass-through effect of higher interest rates?

Has immigration weakened the link between interest rates and our housing market?

I wish I had all the answers, but I do know this: not all households and corporates managed to fix the rate on their debt at super-low rates.

Corporate defaults have been rising in spite of strong economic growth which means there is buckling at the edges.

Rising delinquencies on consumer loans and credit cards are signs that policy has become restrictive.

At some point, the edges creep into the middle. The lagged effects finally show up, tail risks become the central risk, and the gradual recession becomes a sudden one.

The second way to a hard landing is via no landing. This would push the timing more towards next year.

A no-landing scenario raises the chances that inflation will resurge.

I’m not a massive subscriber to this view as I think there is enough in the inflation and wage data to support a continued disinflation trend.

But I acknowledge that markets will not take kindly to any disappointment on inflation.

A more likely version of this path to hard landing is that during a no-landing phase, central banks feel reluctant to cut rates.

As the lagged effects of restrictive policy catch up with the real economy, the economy eventually falls into a hard landing.

This may also be why the US yield curve has stayed inverted.

Active decisions in times of uncertainty

Let’s bring this back to positioning implications.

The summary of my view change from a few months ago is that I am still not seeing a step down in consumer appetite.

That means disinflation alone is insufficient for driving a strong rally in bonds.

In addition, near-term risks may be skewed to further bond volatility as the market tries on the no-landing narrative.

For our income portfolios, our long bias on duration has eased, and I’m happy to tactically take duration exposures all the way down to minimal levels.

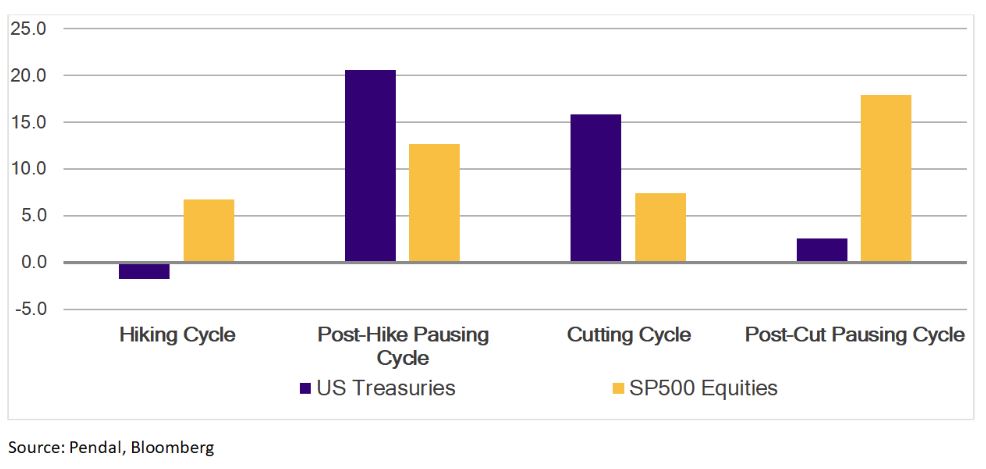

I still like bonds and higher yields offer great asymmetry.

But I really like bonds because I think the hiking cycle (at least in the US) is over.

In an active portfolio, the way to express this is to buy-on-dips and be prepared to take the gains when you have them.

At least for the next couple of months.

I also won’t say no to buying dips in risky assets along the way.

Equities (and credit) do well as long as growth holds up. The prolonged “everything sell-off” in 2022 had as much to do with a deteriorating growth outlook as it did soaring inflation.

It’s hard for anything to do well in the face of stagflation.

In 2024, as long as the growth backdrop remains healthy, everything sell-offs are likely to be good buy-the-dip opportunities.

The core returns driver in our income strategies continues to be high-quality, investment-grade credit.

The pace of corporate bond issuance in Australia has started this year with a bang, all met with very strong demand.

While selective, our portfolios have not shied away from participating in those opportunities.

But I’m keeping an eye on default rates.

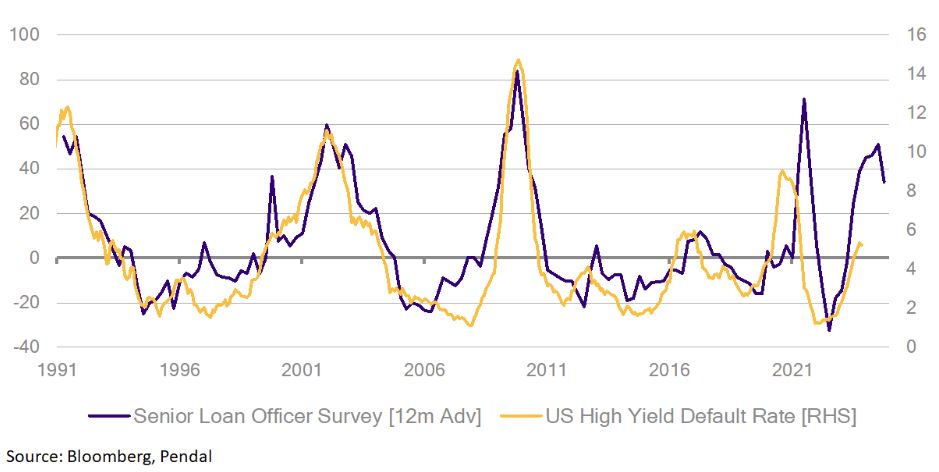

As Figure 9 shows, tightening credit conditions tend to lead to higher default rates with a decent lag.

Even though lending standards have begun to loosen, default rates are still rising.

So far, global credit spreads have shrugged off higher default rates, which would be correct if the soft landing has already happened.

However, if this old relationship holds, having a higher quality and liquidity bias in our credit portfolios will give us the resilience and flexibility to navigate an uglier market environment.

About Amy Xie Patrick and Pendal’s Income and Fixed Interest team

Amy is Pendal’s Head of Income Strategies. She has extensive expertise and experience in emerging markets, global high yield and investment grade credit and holds an honours degree in economics from Cambridge University.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. The team oversees some $20 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at March 6, 2024.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Funds and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Funds is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Funds.

An investment in the Funds or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com