Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Tim Hext: A glimpse of what could have been

The national accounts show potential for a solid 2022 when economies reopen and we learn to live with Covid, writes Tim Hext in his weekly bond, income and defensive strategies outlook

REMEMBER the complacent days of June?

When a limo driver transporting aircrew from the Delta-infected US was legally allowed to drive unvaccinated — with no mask and no testing?

When only a quarter of adults had their first vaccine shot and we were last in the OECD vaccination race (which was “not a race”?)

Before we discovered 99.9% control was 0.1% too little, spelling doom as the highly infectious variant began to spread?

This week we got a glimpse of how well the economy was doing back then with the latest National Accounts data from the Australian Bureau of Statistics.

We are now seeing what could have been.

Find out about

Pendal’s Income and Fixed Interest funds

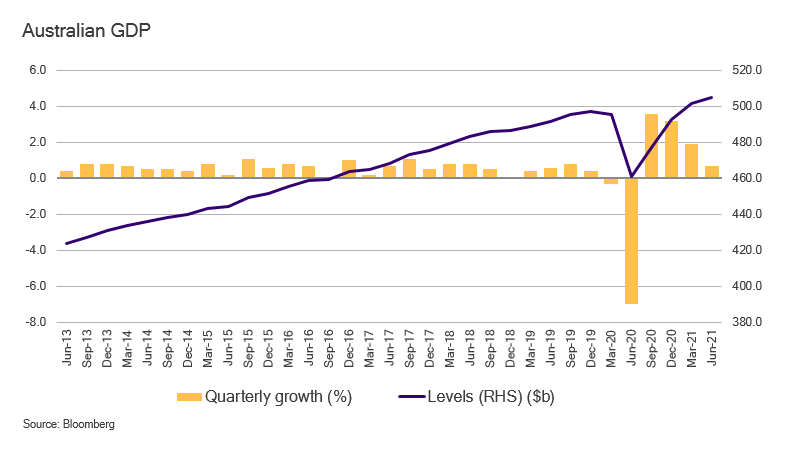

The National Accounts showed an economy 1.6% higher than pre-pandemic.

A rise of only 1.6% over 18 months would normally be cause for concern. But I think everyone can agree it was very impressive given everything that’s happened.

The V-shaped recovery did its job. Now we’ll no doubt debate which letter Recovery Mark II will look like as we dip down in Q3.

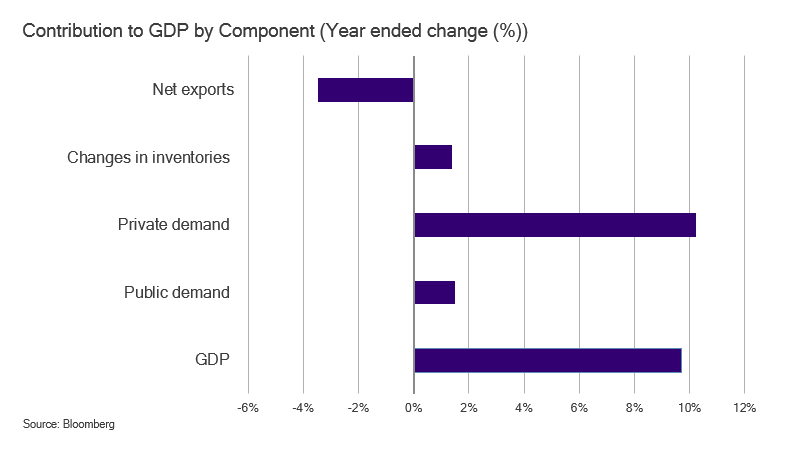

The June quarter was dominated by the return of the consumer.

Household spending was back to pre-pandemic levels as consumers returned. Service spending was up 1.3% in the quarter. Compensation of employees was also up 1.2% — more hours and more jobs.

GDP is a volume measure. A fall in export volumes and pick-up in imports means the external sector subtracted 1% from GDP, keeping the overall number down at 0.7%.

Year-on-year numbers show a rapid climb back from June last year:

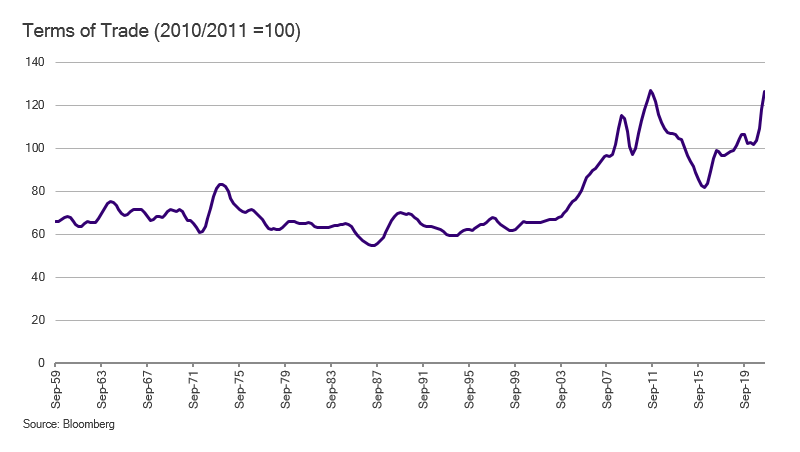

However the nominal economy is more important to our hip pockets and here the news was even better.

Strong commodity prices, particularly iron ore, meant the nominal economy expanded 3.2% in the quarter.

The terms of trade got back to the dazzling days of 2012. The RBA will be thankful this time the Australian dollar is 73c rather than $1.10.

Probably the most encouraging aspect of the report was business investment, which increased by 2.4%.

Generous write-offs no doubt played a part. But after a decade of flat-lining, the growth will be welcomed.

This is one area where we think the post-Covid economic reset will help.

Of course this is all rear-vision mirror now. But it shows the potential for a solid 2022 once economies reopen and we learn to live with Covid.

Bond markets largely ignored these numbers. But yields moved slightly higher this week, mainly on the back of better numbers out of Europe.

Perhaps the light at the end of the tunnel is getting brighter…

About Tim Hext and Pendal’s Income & Fixed Interest boutique

Tim Hext is a Pendal portfolio manager and head of government bond strategies in our Income and Fixed Interest team.

Tim has extensive experience in banking, financial markets and funding including senior positions with NSW Treasury Corporation (TCorp), Westpac Treasury, Commonwealth Bank of Australia, Deutsche Bank, Bain & Co and Swiss Bank Corporation.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia.

The team won Lonsec’s Active Fixed Income Fund of the Year award in 2021 and Zenith’s Australian Fixed Interest award in 2020.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

In 2023, Pendal became part of Perpetual Limited (ASX:PPT), bringing together two of Australia’s most respected active asset management brands to create a global leader in multi-boutique asset management with autonomous, world-class investment capabilities and a growing leadership position in ESG.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at September 3, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.