Crispin Murray: the big policy shifts that are driving equities

Major shifts in policy-making — driven by the Covid crisis and a desire to correct GFC-era mistakes — can drive equities higher despite pockets of excess, says Pendal’s head of equities Crispin Murray (pictured).

Here are some insights from reporting season, drawn from Crispin’s bi-annual Beyond The Numbers presentation.

Watch the presentation here (registration required).

Key points

- Equities to benefit from major shifts in policy goals

- A number of factors are driving rotation from growth to value

- Performance is not simply “buy value, sell growth”

- Find out about Pendal Focus Australian Share Fund

INVESTORS may see pockets of excess in markets at the moment — but that’s not necessarily a sign that we’ve reached a top in equities, says Pendal’s Head of Australian Equities Crispin Murray.

These are symptoms of a policy agenda designed to avoid the mistakes of the Global Financial Crisis era.

That era resulted in fiscal austerity, pre-emptive monetary tightening and a focus on economic goals to the exclusion of other factors.

Today policy makers are thinking more about reducing inequality, building economic resilience and a greater role for clean energy.

This means bigger fiscal spending and very accommodative monetary policy.

Coupled with the impact of pent-up demand amid a re-opening economy and the return of fund inflows, this should combine to drive the stock market higher, Murray believes.

But he cautions investors to watch for additional complexity in markets.

For example Covid has accelerated structural trends such as the transformation of work via digitalisation and the impact of Environmental, Social and Governance factors when scrutinising companies.

Growing concern about inflation can also trigger bond market sell-offs which can have varying impacts across equity market sectors.

“We think equity markets will be resilient in the face of rising bond yields,” he says. “[But] they do have a big effect on what’s going to actually perform in the market.”

Higher inflation expectations and bond yields are seeing market leadership shift away from growth to cyclicals with pricing power. This suits the Australian markets, he says.

But future outperformance is not a simple matter of buying value stocks and avoiding growth stocks.

“There are still going to be companies in the value sector that are structurally disadvantaged.

“And you’re going to find companies in the growth sector that still have incredibly strong franchises. So, you need to be nuanced about your stock selection.”

The environment is ripe for an active, style-neutral approach focused on company specifics.

Four components of a well-constructed equities portfolio

Murray says a well-constructed portfolio should have four components:

- First, defensive stocks are needed to protect against risk and the chance of policymakers changing their minds.

- Second, a portfolio should have exposure to stocks that are leveraged to the potential inflationary pressures coming through.

- Third, investors should hold companies that used the crisis to improve their position and are ready to benefit from the release of pent-up demand.

- And finally, investors should consider the companies hit hardest by the pandemic who will see a material shift in fortune once the vaccines roll out.

“When we think about our portfolio, we think about the different roles stocks play. Like a football team, you need the defence, you need the midfield, and you need the attack.”

About Crispin Murray and Pendal Focus Australian Share Fund

Crispin Murray is Pendal’s Head of Equities. He has more than 27 years of investment experience and leads one of the largest equities teams in Australia.

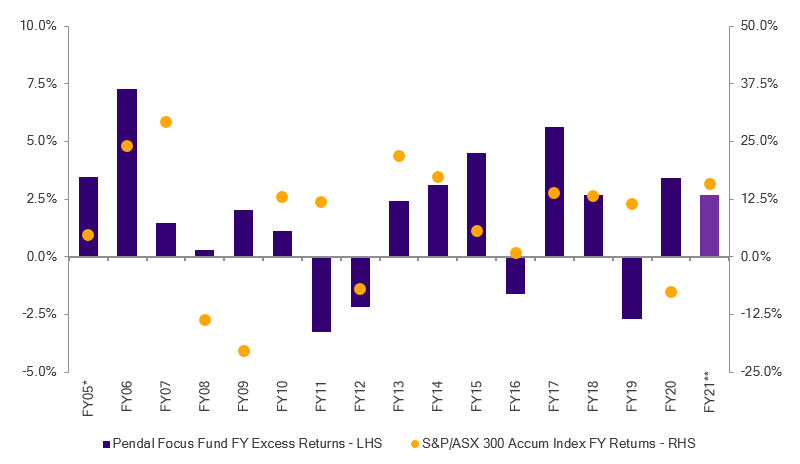

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions, as this graph shows:

Source: Pendal. Performance is after fees and before taxes. *From 01 Apr 05; **as at 28 Feb 21.

Past performance is not a reliable indicator of future performance.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Find out more about Pendal Focus Australian Share Fund here.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at March 09, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided. This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.