Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Anna Hong: What’s keeping Dr Lowe up at night

What are the implications for investors from this week’s RBA statement? Where might Dr Lowe go next? Pendal’s ANNA HONG explains

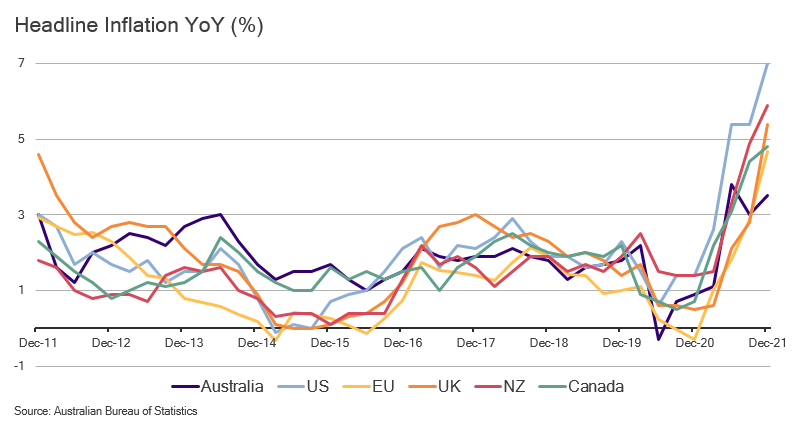

ON A global scale, the picture looks pretty clear — inflation is here.

Here is a comparison of year-on-year headline inflation growth:

- United States 7%

- United Kingdom 5.4%

- Eurozone 4.7%

- Canada 4.8%

- New Zealand 5.9%

- Australia 3.5%

Australian inflation appears modest in comparison to other regions.

But after the RBA has repeatedly reiterated a target inflation band of 2% to 3%, the market is understandably confused.

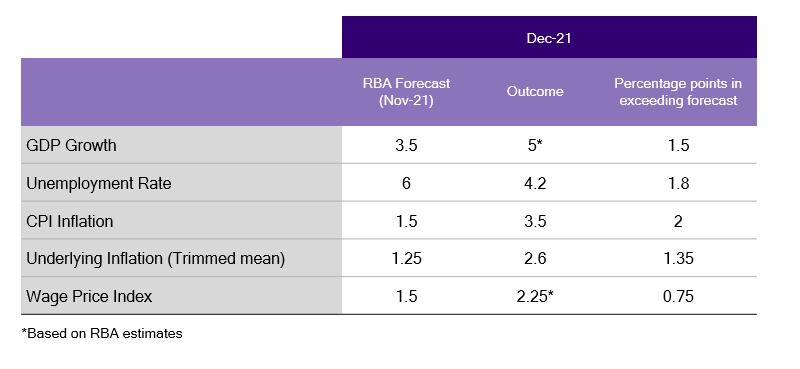

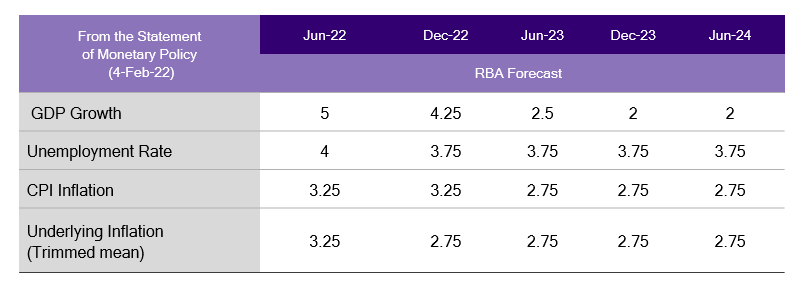

As you can see below, actual data for Q4 2021 exceeded that target — and the RBA is forecasting inflation in the higher part of the target range through to 2024.

Yet the Reserve is saying “no rate hike in the near-term”.

Never before has the RBA been so wrong, so quickly.

This week the central bank was forced to revise its February forecasts to match the market since the data showed that the market was correct.

That led to a stand-off on Tuesday after the RBA statement. The front end of the yield curve rallied but without commitment. Yes, lower for just a bit longer…wait, but how much longer?

The RBA provided a few breadcrumbs for the market to follow.

Dr Lowe’s National Press Club speech made it clear the Reserve was not working off “a specific definition as to what ‘sustainably in the target range’ means”.

It will depend instead on the rate, trajectory, outlook, and drivers of the inflation. In a nutshell – it will be all be about wages.

Why do wages keep Dr Lowe up at night?

In the past 10 years wages growth alongside goods prices have been the main reasons inflation stayed below target.

The RBA appears to be pre-empting the dampening effects of the border re-opening.

It remains worried about the impact on wages if the number of temporary visa holders returns to the pre-pandemic levels. See graphs below.

What are the implications?

The RBA’s preparedness to miss the Q1 and probably Q2 global rate hike party, means conditions for mortgage holders, share markets and owners of short bonds remain supportive.

The picture for long bonds is less clear.

We expect real rates to rise in the months ahead, which is very likely to move nominal yields higher as well.

About Anna Hong and Pendal’s Income and Fixed Interest team

Anna Hong is an assistant portfolio manager with Pendal’s Income and Fixed Interest team.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. In 2020 the team won the Australian Fixed Interest category in the Zenith awards.

With the goal of building the most defensive line of funds in Australia, the team oversees A$22 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at January 4, 2022.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.

An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com