Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

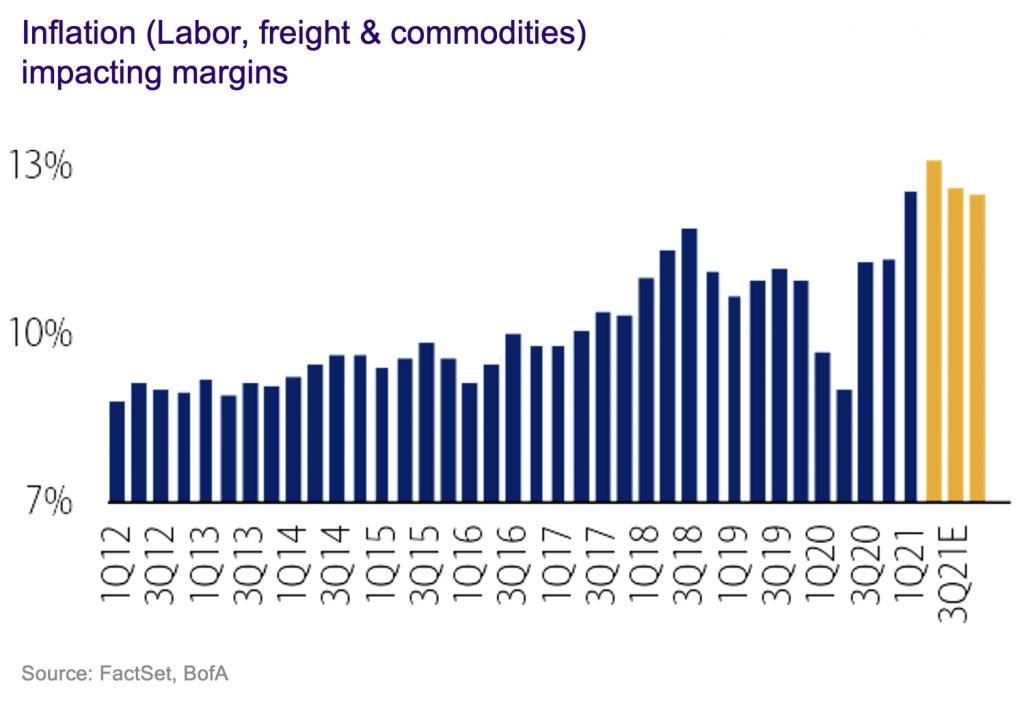

Worried about inflation? Keep an eye on capital spending in the business world

If the pick-up in capital spending among businesses continues, higher prices are much more likely to be here to stay, says Pendal’s head of global equities Ashley Pittard

- Capital spending can trigger longer term, sustainable inflation

- Big rises in profit margins spur businesses to invest

- Evidence points to inflation shifting from transitory to structural

CAPITAL spending is the dark horse in the debate on inflation, says Pendal’s head of equities Ashley Pittard.

Wage and transport costs and consumer spending tend to grab the headlines. But capital investment by business, with long lead times, can provide a significant, sustainable fillip to prices.

“If we start seeing capital expenditure re-rating year on year, that will solidify inflation coming through,” says Ashley Pittard, head of Pendal’s Global Equities boutique.

“In the first quarter of this year capex was mixed in the United States. But in the second quarter it was the strongest capex since 2004.”

The prospect of inflation remains the big question in financial markets: is it transitory or structural?

Central banks around the world have mostly argued it is transitory. But in recent weeks the US Federal Reserve, the European Central Bank and the Reserve Bank of Australia, among others, have spoken of winding back bond purchase programs.

If the pick-up in capital spending continues, higher prices are much more likely to be here to stay.

Businesses, particularly in Europe and North America, are willing to invest because of the earnings boosts they’ve experienced in the first half of this year — and based on improved profit margins.

“Earnings growth is up almost 100 per cent across the S&P500 for the June quarter, but sales growth was up only 27 per cent,” Pittard says.

“In Europe, the sales growth was 28 per cent, which is very similar, but the earnings growth was 243 per cent.”

Europe’s outperformance partly reflects the mix of sectors with energies and financials higher contributors to European bourses. Those sectors have done very well with commodity prices rising, and relatively few bad debts to deal with for the banks.

Also, Europe started from a lower base and had more scope to climb, Pittard says.

“Earnings have been strong year-on-year and against 2019. But companies are also getting massive margin expansion and in some cases the highest margins ever,” he says. “This is encouraging capital spending which is adding to inflation.”

Find out about

Pendal Concentrated Global Share Fund

Price rises are already coming through with US inflation up 7.8 per cent in July, German inflation at 3.4 per cent (the highest rate since 2008) and Spain at 3.3 per cent.

“You are seeing Europe getting inflation in the mid threes. You have the US with inflation well above 5 per cent,” Pittard says.

For businesses, when borrowing is so cheap, and earnings are rising, they pay down their debt quicker and can invest more, he says.

If the investment is productive it can eventually reduce inflation. But in the short-to-medium term it will put pressure on prices.

Capital spending adds another piece of the argument that inflation is more than transitory.

“There is no doubt it is a timing issue before transitory inflation becomes structural inflation,” Pittard says.

About Ashley Pittard and Pendal Concentrated Global Share Fund

Ashley Pittard leads Pendal’s Global Equities investment boutique. He is responsible for setting the strategy, processes and risk management for the boutique and its funds including Pendal Concentrated Global Share (COGS) Fund.

Ashley has more than 24 years of finance experience, including roles in petroleum economics, global energy investment analysis and 20 years as a global equities fund manager.

Pendal COGS Fund is an actively managed, concentrated portfolio of global shares diversified across a broad range of global sharemarkets.

Find out more about Pendal Concentrated Global Share Fund

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at September 15, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided. This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.