Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

What are sustainability-linked bonds and why investors should care

A new kind of bond offers features based on whether an issuer achieves sustainability goals by a deadline. Pendal Credit ESG Analyst Murray Ackman explains the pros and cons

EVERY YEAR we get asked “what are your New Year resolutions?’” Every year I come up with a few, but they tend to fade before the change of season.

When Sydney went into a Covid lockdown at the end of June I decided to try a few new self-improvement goals. As lockdown stretched on (and after some feedback from my mother) I gave up on my “no shaving” goal.

But other goals were more sustainable.

After another day of meeting goals, I got to thinking about why I’d had more success during lockdown compared to my New Year’s resolutions.

A few things came to mind. I told people about them. And I actually wanted to achieve them, rather than it being an arbitrary decision based on the end of the calendar year.

The goals had a deadline and were easily measurable. And I had skin in the game by way of a friendly wager.

How might that apply to a business?

If a business wanted to change, would a New Year’s resolution pledge be enough? Or would it need more incentive to succeed?

Can capital markets encourage businesses to become more sustainable?

This is how I think about a recent change in capital markets: the sustainability-linked bond.

What are sustainability-linked bonds?

Sustainability-linked bonds are a bond instrument where certain features vary based on whether the issuer achieves pre-defined sustainability goals within a timeframe.

Like my lockdown goals, this is an issuer making a statement that they will achieve something by a certain time, such as reducing emissions.

If they fail they have to pay up.

Pendal Sustainable Australian Fixed Interest Fund

An Aussie bond fund that aims to outperform its benchmark while targeting environmental and social outcomes via a portion of its holdings.

This generally takes place though a coupon step-up. An issuer will have to pay investors more if they don’t achieve specific environmental or social goals.

Unlike green, social and sustainability bonds, these are not use-of-proceeds bonds earmarked for specific purposes. They fund general corporate purposes.

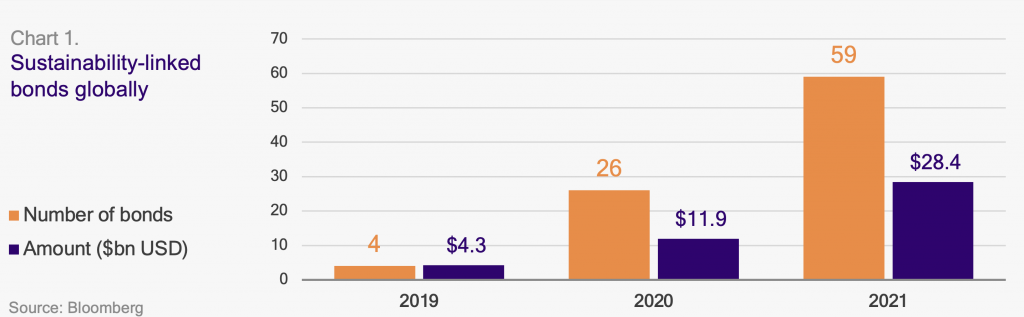

These are relatively new instruments. Globally, there have been a few issuances of sustainability-linked bonds and only one in Australia by Wesfarmers in June.

All sustainability-linked bonds have been oversubscribed and there is growing investor appetite for this type of bond.

Sustainability-linked bonds make public a company’s intention to achieve certain goals by tying financing to sustainability.

For current issuers, they offer a different list of investors and are easier to issue rather than transition or use-of-proceeds bonds.

Only a handful of corporates can do the ring-fencing required for green or social bonds.

Most of these sustainability-linked bonds have featured goals relating to emissions reductions, renewable energy generation, recycling and better waste practices. These are challenges that every business has.

These bonds are a welcome inclusion for capital markets.

They can provide a way for issuers to put something on the line to demonstrate they are serious about targets regardless of the business environment or the energy of specific champions within a business.

Potential concerns

As a new instrument, there are still some outstanding issues, particularly for sustainable investors.

Firstly, these bonds are easier to issue than other sustainable bonds. That means potential uncertainty about whether an issuer cares about sustainability or if they are using the instrument as a way to get cheap debt.

Find out about

Regnan Credit Impact Trust

Secondly, there can be doubts about whether the targets stretch a company beyond what they were planning to do anyway.

There will likely be a “first-mover” benefit whereby company targets become less aggressive compared to peers as more bonds are issued.

Thirdly, there are idiosyncratic concerns for sustainability funds. If an issuer doesn’t hit their step-up, this can potentially hurt an investor. Then it’s no longer a sustainability-linked bond and may need to be sold to comply with the mandate of a fund.

If there is a mass exodus, a step-up of 25bps — the amount generally seen in the international market — won’t necessarily compensate a forced sell-off by a sustainability fund that is not looking to hold more vanilla issuances.

The right direction

This is an evolving market.

Through greater engagement among issuers, arrangers and investors, there is hope that sustainability-linked bonds can improve sustainability offerings in debt markets.

It’s one of many initiatives for helping issuers become more sustainable.

This is about making a public statement with intent, measurable goals and putting something on the line.

It’s working for me.

About Murray Ackman and Pendal’s Income and Fixed Interest boutique

Credit ESG analyst Murray Ackman joined Pendal’s Income and Fixed Interest team in 2020 to provide fundamental credit analysis and integrate Environmental, Social and Governance factors across credit funds.

Murray has worked as a consultant measuring ESG for family offices and private equity firms and was a Research Fellow at the Institute for Economics and Peace where he led research on the United Nations Sustainable Development Goals.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia.

The team’s awards include Lonsec’s Active Fixed Income Fund of the Year (2022) and Zenith’s Sustainable and Responsible Investments — Income award (2023).

Regnan Credit Impact Trust is an investment strategy that puts capital to work for positive change.

Pendal Sustainable Australian Fixed Interest Fund is an Aussie bond fund that aims to outperform its benchmark while targeting environmental and social outcomes via a portion of its holdings.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at September 15, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.