Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Wages are slowly rising, but inflation is rising faster

A quick investor’s guide to this week’s economic events with portfolio manager TIM HEXT from Pendal’s Income and Fixed Interest team

THE main event for Australian bond markets this week was Wednesday’s release of the Wage Price Index (WPI) for the September quarter.

This number has gained importance with Dr Lowe’s strong view that a sustainable inflation rate at the RBA target (2.5%) is highly unlikely without wage growth comfortably over 3%.

Effectively wages have become a hurdle to cash rate hikes.

So who won this week’s battle between the RBA (no hikes in 2022) and the market (75 basis point of hikes in 2022)?

Well it was a rare recent victory for the RBA.

Inflation prints of late have left the RBA shaky. But the latest wages number fitted the RBA narrative and the market cut expectations from 75 to 60 basis point of hikes.

The WPI showed wages growth of 0.6% for the quarter and 2.2% for the year. Reports of labour shortages and accelerating wage growth are yet to show through in a meaningful way.

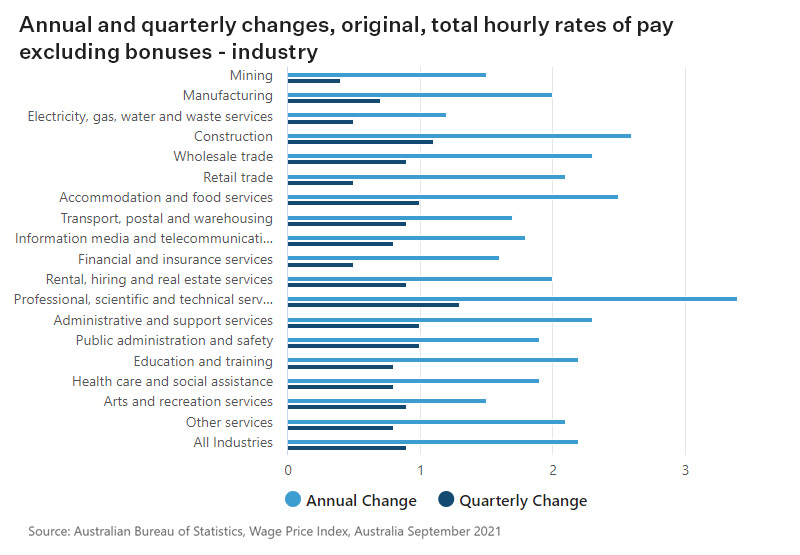

As you can see below, only one of 18 industries measured was over 3% (Professional, Scientific and Technical Services at 3.4%) and only another two above 2.5% (Construction at 2.6% and Accommodation and Food Services at 2.5%).

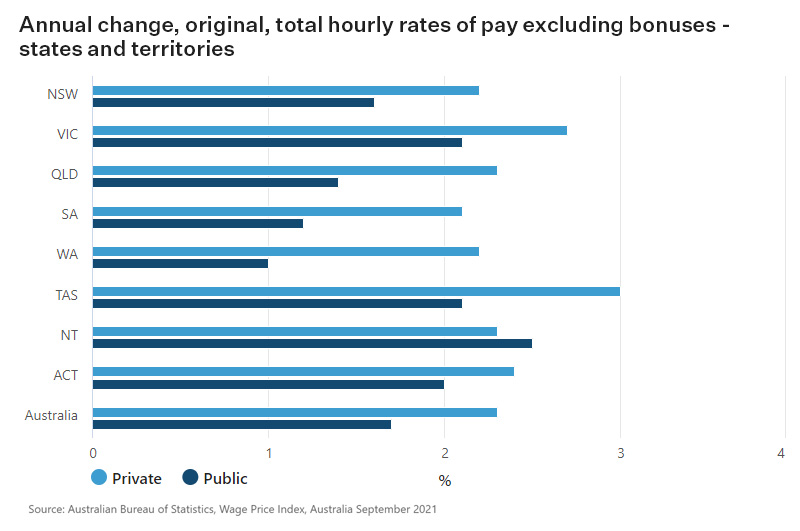

Data by state was also surprising, as you can see below.

You’d think Western Australia — with a booming economy, closed borders and unemployment at 3.9% — would be seeing massive pressure on wages. Apparently not with 2.2% wages growth. Only Tasmania is nearing 3%.

Some of this is due to the inertia of our wage arrangements. Many awards are only negotiated every three years.

Recent awards seem to be targeting 3% and successfully getting it.

Unions know for the first time in a while they hold the better cards. Many are now saying 3% is the minimum they expect. They have the RBA in their camp.

Rather predictably employers are pushing back and asking for quicker border re-openings to give them an increased pool of labour.

Recent reporting seasons suggest most larger companies are able to pass on good times to their workers, even if not willingly.

Public sector wages have been a handbrake, but most states are now back to the 2.5% level of the last decade.

The federal government has moved from the 2% that Abbott brought in, back to matching the private sector.

Find out about

Pendal’s Income and Fixed Interest funds

Where to from here?

Everyone’s in fierce agreement that wages are going up — but by how much and when?

This is crucial for the interest rate outlook. Given the WPI is an average, to hit 3.5% wage growth you need a lot of 4-to-5% outcomes to counter the many stuck at zero (hello finance) and 2.5%.

There have been isolated cases of 5% or 10% rises in areas such as or Accounting and these could well spread further.

But until we see large-scale awards going through at 4% or 5% — or a similar minimum wage outcome — wages well above 3% seem unlikely.

Maybe it’s a 2023 outcome. I suspect we will get there, but for now Dr Lowe looks to be correct in his patience.

Since wages are the ultimate lagging indicator, markets will not share that patience.

Our portfolios have covered short-duration positions. Depending on levels we will likely wait until early next year before re-establishing.

The two months of upcoming radio silence from the RBA and the lack of domestic inflation data until late January means we will be buffeted by offshore markets.

Steep curves though mean it is costly to sit in cash through the summer.

About Tim Hext and Pendal’s Income & Fixed Interest boutique

Tim Hext is a Pendal portfolio manager and head of government bond strategies in our Income and Fixed Interest team.

Tim has extensive experience in banking, financial markets and funding including senior positions with NSW Treasury Corporation (TCorp), Westpac Treasury, Commonwealth Bank of Australia, Deutsche Bank, Bain & Co and Swiss Bank Corporation.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia.

The team won Lonsec’s Active Fixed Income Fund of the Year award in 2021 and Zenith’s Australian Fixed Interest award in 2020.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is a global investment management business focused on delivering superior investment returns for our clients through active management.

In 2023, Pendal became part of Perpetual Limited (ASX:PPT), bringing together two of Australia’s most respected active asset management brands to create a global leader in multi-boutique asset management with autonomous, world-class investment capabilities and a growing leadership position in ESG.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at November 19, 2021.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.

An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com