Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Sustainable investing in infrastructure and REITs? It’s possible. Here’s how

Sustainable investing options aren’t as obvious in property and infrastructure as they are in equities and fixed income. Michael Blayney explains what to look for

INVESTING in property and infrastructure in a sustainable way isn’t always as easy or obvious as buying into equities and fixed income.

Add in structural challenges amplified by the pandemic and it’s clear investors need to do their homework to find opportunities in the world of real assets.

But there are opportunities.

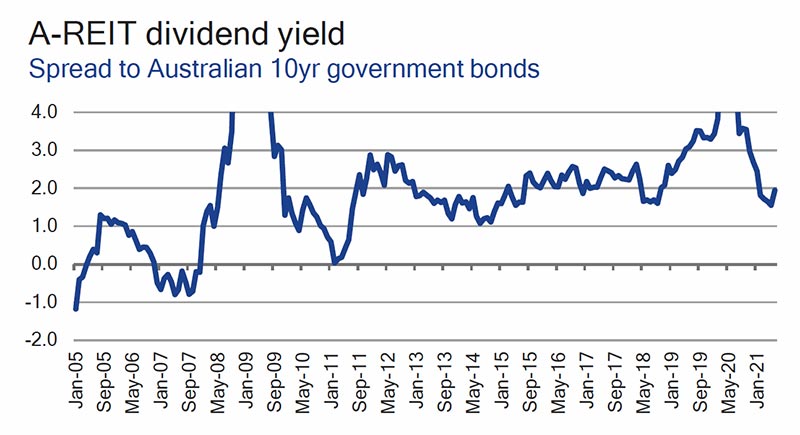

“Long term, inflation-linked cash flows are attractive, albeit with some downside risk due to REITs [Real Estate Investment Trusts] interest rate sensitivity,” says Michael Blayney, head of Pendal’s multi-asset investment team.

“They are also relatively high-yielding assets.”

Similarly, there are opportunities in infrastructure, with long-term, stable returns, particularly from assets that will benefit from the transition to a low-carbon economy.

But sorting through the options can be hard going.

In the property world it’s a challenge finding a benchmark to compare one asset with another.

“In respect of the overall opportunity set of negative exclusions for REITs, any impact is relatively less than general equities,” Blayney says.

“The most obvious exclusions are landlords of hotels or casinos. In Australia, that impacts less than 1 per cent of the A-REIT universe. Globally it can be up to 5 per cent of the universe, depending on how strictly screening criteria are applied.”

Few major portfolio construction issues are caused by explicitly excluding these sub-sectors.

“The bigger issue is the lack of dedicated sustainable product in the AREIT category,” Blayney says.

In the infrastructure world, investors can get access to some of the biggest polluters — such as utilities and assets trying to find climate solutions — and promote the transition to a low-carbon economy.

Find out about

Pendal Multi-Asset Funds

“Typical listed infrastructure portfolios are often exposed to carbon risk, because many assets are inherently linked to the use and distribution of fossil fuels — such as electric and gas utilities, some seaports, pipelines, and also airports,” Blayney says.

“Toll roads are less of an issue than airports, since decarbonising cars is already happening. But large-scale decarbonised air travel is not yet a reality.

“Digital infrastructure, such as data centres, are somewhat of a conundrum.

“On one hand greater uptake of technology can act to reduce emissions via less commuting and less business travel. On the other hand datacentres can have a significant carbon footprint due to high levels of energy consumption.

“Other assets in the digital infrastructure category — such as fibre and towers — can also make a positive contribution to decarbonisation via reduced commuting and business travel, and enabling a portfolio to leverage itself for growth in the digital economy,” Blayney says.

“Finally, within infrastructure allocations, investors have an opportunity to support clean-energy technologies while earning a strong risk-adjusted return.

“Examples include investing in renewable energy generation, in large-scale battery storage technology, and in better waste management,” he says.

How much portfolio construction in property and alternatives is influenced by ESG factors or sustainability considerations depends much more on implementation — and the subjective views of the portfolio manager making the investment decisions — rather than the hard screening of the assets themselves, says Blayney.

About Pendal’s multi-asset capabilities

Pendal’s diversified funds provide investors with a variety of traditional and alternative asset classes and strategies.

These include Australian and international shares, property securities, fixed interest, cash investments and alternatives.

In March 2024, Perpetual Group brought together the Pendal and Perpetual multi-asset teams under the leadership of Michael O’Dea.

The newly expanded nine-strong team will manage more than $6 billion in AUM and create a platform with the scale and resources to deliver leading multi-asset solutions for clients.

Michael is a highly experienced investor with more than 23 years industry experience, including almost a decade leading the team at Perpetual.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at August 25, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.