Steve Campbell: Liquidity everywhere – the chase for yield

Liquidity everywhere – the chase for yield: portfolio manager Steve Campbell (pictured) of Pendal’s Bond, Income, and Defensive Strategies team will discuss this in the article below.

The Reserve Bank’s Statement on Monetary Policy in May contained its forecasts for the Australian economy out to June 2022.

The statement highlights significant headwinds ahead for the Australian economy, even allowing for the fact that some forecasts may be too pessimistic.

In its most recent economic forecasts, the RBA revised down economic growth for the year to June 2020 by almost 10% to -8%. For the year to December economic growth is forecast to be -6%, a downward revision of 8.7%.

This would normally result in an aggressive cut to the cash rate. But with a starting point of just 1.50% from mid-2019 – and the RBA’s aversion to negative interest rate policy – we have seen the cash rate cut by just 125 basis points.

If the magnitude rather than the level matters, it’s paltry when all else is considered. Contrast this with the GFC experience and the RBA’s forecast revisions around that time.

For the year to June 2009, economic growth was revised down from growth of 2.25% in August 2008 to -1.25% in May 2009. A 3.5% fall in forecast economic growth saw the cash rate cut from 7.25% to 3% versus a 10% fall in forecast growth that has seen the cash rate cut from 1.50% to 0.25%.

The RBA is not alone in the limited ammunition available via conventional monetary policy.

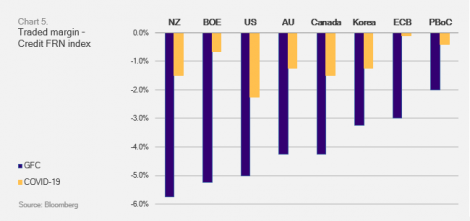

The following graph shows the total changes to cash rates during the GFC and the most recent moves due to COVID-19.

What does this mean going forward? The RBA has moved into more unconventional areas with the use of yield curve control and the term funding facility. With the damage wrought on the economy, further stimulus is warranted – be it fiscal or monetary.

Modern Monetary Theory is something that will garner more and more discussion in this period. The output that has been lost as a result of COVID-19 will take a long period to recover.

For cash investors returns are going to remain extremely low. If other central banks implement negative interest rates it cannot be ruled out here either. Although the RBA certainly won’t be leading the charge into the next wave of negative rate club members.

Steve Campbell – portfolio manager with Pendal’s Bond, Income and Defensive Strategies team.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Find out more about our investment capabilities:

https://www.pendalgroup.com/about/investment-capabilities

Contact a Pendal key account manager: