Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Net zero for investors: what the new business mantra means

Net zero is a megatrend that will define the business landscape for decades. Pendal analyst and co-portfolio manager Oliver Renton explains what it means for investors

- Net zero carbon emissions required to halt global warming

- Hydrogen and carbon capture the key technologies

- Find out about Pendal Focus Australian Share fund

NET ZERO has become a mantra for many businesses in recent months as governments and corporations outdo each other in their commitments to reducing carbon emissions and fighting climate change.

The noise will reach a peak at November’s United Nations climate change summit in Glasgow but arguably the real work to achieve net zero has yet to begin.

Every nation and every company will need to a play a role reducing carbon emissions to avoid the worst effects of global warming. That defines net zero as a megatrend that will define the planet for decades.

“There aren’t that many certainties in investing but the move towards Net Zero is one of them,” says Oliver Renton, an energy analyst at Pendal Group. “It’s a helpful framework in which to invest.”

But what exactly is net zero?

How does the world get there?

And what does it really mean for investors?

What is net zero?

Scientists agree it is unequivocal that human influence has warmed the planet and this can be attributed to increasing greenhouse gases in the atmosphere including carbon dioxide, methane and nitrous oxide.

These emissions are combined into a measure known as “carbon dioxide equivalents” and referred to simply as “carbon” for simplicity.

A wide range of human activities generate greenhouse gases including construction and manufacturing, generating electricity, agriculture, transport and heating and cooling.

To limit warming to 1.5 degrees Celsius above pre-industrial levels – a level scientists estimate to be safe – governments agreed in Paris in 2015 that carbon neutrality by the mid-21st century was essential.

Net zero by 2050 refers to this goal of a mid-century point of neutrality where humans add no more greenhouse gases to the atmosphere than is removed.

Of course, net zero does not mean zero.

Greenhouse gases have always been emitted but historically emissions were absorbed into forests, oceans and soil and the cycle was roughly balanced.

Getting to net zero means carbon emitted by humans is balanced by carbon removed from the atmosphere.

How to get to net zero

There are essentially two ways the world can get to net zero carbon emissions, says Renton:

- Reducing demand for carbon producing activities, and

- Changing the way these activities are undertaken to eliminate emissions

But energy usage and economic growth are inextricably linked. Taking a demand-reduction approach to emissions generally means reducing living standards in prosperous countries and condemning much of the developing world to poverty. (There is of course energy efficiency available to aid in the move to net zero.)

“Developing countries want and deserve to live a more energy-intensive lifestyle,” says Renton.

“Energy poverty is an ESG [Environmental, Social and Governance] issue as much as the environmental impacts of carbon. So, it’s important to take a broad perspective.”

That means solving net zero predominantly falls to the supply side.

The role of energy

Almost all aspects of human society use energy. Right now 80 per cent of the world’s energy supply comes from carbon-emitting fossil fuels, chiefly oil, coal and gas, says Renton.

The remaining 20 per cent comes from non-carbon emitting sources like nuclear, hydroelectricity and renewables.

Importantly, for all the focus on electric vehicles, only about quarter of energy use is transport and only half of that is passenger vehicles.

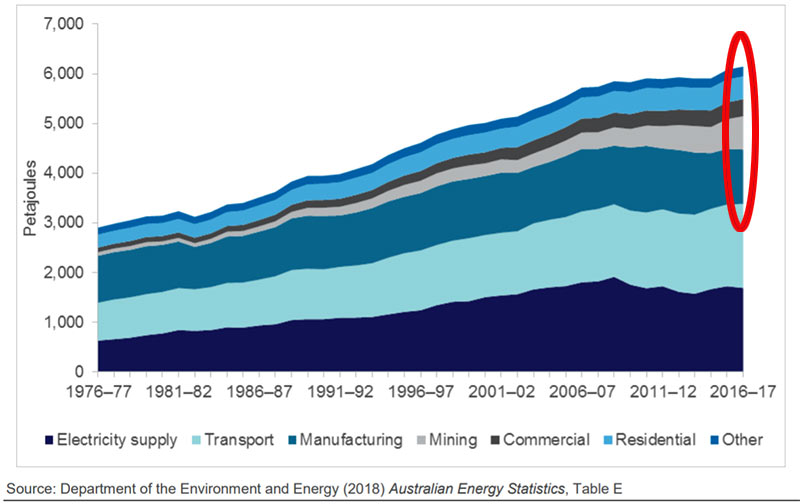

In Australia, the bulk of energy consumption is electricity generation. Other big energy users are manufacturing and mining, the retail and services industries and households.

Australian energy consumption by sector (2018):

So where does that leave net zero?

“We have pretty good solutions for electricity supply and transport in the form of renewables and batteries,” says Renton.

“But half of energy consumption is considered hard to abate and thousands of different solutions will be required.”

One way to analyse how these solutions could play out is to follow how energy is delivered to end users.

Electricity is only one way energy is delivered – and represents about 20 per cent of global energy demand. The 80 per cent remainder is still dominated by oil, coal and gas.

“Even under the best scenarios, electricity only gets to 30 or 40 per cent share – it’s just not feasible to electrify everything,” says Renton.

“So, we still need a solution for transportable liquid or gas forms of energy.

“This is a very interesting insight – because at the moment, the net zero commodity that can be used to transport energy does not exist in a commercial way.”

Technology solutions

The answer to this puzzle lies with technology.

“We’re going to need technological breakthroughs throughout the whole system. But historically, we underestimate the effect of technological change and miss the big picture,” says Renton.

Solar is a case in point. Innovation is driving prices down so rapidly that the solar industry achieved cost milestones some two decades ahead of forecasts.

“It’s pretty unbelievable – and that trajectory can probably be applied to various other aspects of the energy transition.”

The two big hopes for net zero transportable energy are two relatively immature technologies: hydrogen and carbon capture and storage (CCS).

And their prospects are interlinked.

Hydrogen theoretically solves the problem of a transportable, net zero emissions energy source.

Hydrogen is the most abundant and simplest element in the universe and is safer than conventional fuels. It can be manufactured and when burned emits nothing but energy and water. It can be delivered though gas pipelines and used to fuel vehicles.

But, for the foreseeable future, it is too expensive to compete as a fuel.

And worse, depending on how it is made, the hydrogen manufacturing process itself creates carbon.

There are two ways to make hydrogen. The more expensive way is using electricity to split water – a net zero activity only if the electricity itself is carbon free. The cheaper way is to split it from natural gas using steam, but this process produces carbon dioxide as a by-product.

2021 Money Management of the Year Awards

Pendal Australian Shares Portfolio

Winner – SMA Australian Equities

Pendal Property Investment Fund

Winner – Australian Property Securities

The solution? Capturing the carbon emissions and storing them so they cannot add to greenhouse gases in the atmosphere.

This carbon capture and storage (CCS) is the second leg in the net-zero technology race. It quite literally involves a process that captures carbon dioxide from the air — it is in use in fossil fuel power generation and industry.

But its track record is patchy, and the current economics are not promising at mass scale.

“There’s scepticism about carbon capture and storage but it is in everyone’s forecasts to get to net zero,” says Renton.

What does this mean for investors?

Capital markets have already moved in line with net zero.

The cost of capital for fossil fuel energy companies is rising and net zero shareholder resolutions are on the rise.

All evidence shows the energy transition and the drive towards net zero has enormous momentum.

“But energy and fossil fuels have been inextricably linked to GDP and the decoupling will be difficult,” says Renton.

Renton says the challenges facing hydrogen and carbon capture and storage are only resolved in a world where the carbon price is high enough that projects become economic in a timeframe that allows the world to meet its 2050 goals.

“That’s one of the main conclusions for investors — the implicit or explicit price of carbon is going up and it’s really the only solution.”

This means projects that can efficiently reduce carbon emissions are going to be highly valuable.

Ironically, one of the best avenues for investors could be the natural gas industry, which can produce energy at half the emissions intensity of coal.

“We have confidence than the market for gas is there for the medium term, but the focus should be on top-tier projects or projects that complement CCS” says Renton.

Keep an eye on the energy transition

Renton also cautions investors about taking an all-or-nothing approach to assessing investments, saying some fossil fuel companies have the skills, assets and customer base that will allow them to play an important role in the energy transition.

“Look at the fuel companies that distribute fuel on behalf of society — even if we switch to hydrogen these are still difficult substances to deal with. Who are going to be the natural companies to deal with this? They have the skills and existing assets like pipelines and ports that all become very important.

“It’s too narrow a view to label this a dead asset class.”

He says investors should seek out companies with strong management, governance, capital positions, assets that have value in a renewable world and favourable industry structures that will allow them to best hold margins in times of change.

“And look for carbon capture opportunities that can take advantage of a higher carbon price,” he says.

The conclusion? Investors cannot afford to be ideological about net zero.

“The oil and gas companies are the ones that are genuinely going to be the drivers of change – they are the ones developing and distributing hydrogen and the ones capturing and storing carbon.

“Don’t give up on the energy sector – that could be a very poor outcome for the world.”

About Oliver Renton

Oliver is an analyst and co-portfolio manager with Pendal’s Australian equities team. He has more than 15 years of industry experience and focuses on utilities and health care.

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

We believe sustainability considerations ultimately drive higher and more stable investment returns over the long term.

Pendal Group has a proud heritage in responsible investing, extending back decades. Our specialist responsible investing business Regnan includes highly experienced ESG research and engagement experts and offers a growing range of investment strategies.

Find out about some of our responsible investing strategies:

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at September 15, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.