Isn’t it ironic…

Irony – A figure of speech in which the intended meaning is the opposite of that expressed by the words used; usually taking the form of sarcasm or ridicule in which the laudatory expressions are used to imply condemnation or contempt.

“The Walrus and the Carpenter were walking close at hand; they wept like anything to see such quantities of sand: ‘If this were only cleared away,’ they said, ‘it would be grand! If seven maids with seven mops swept it for half a year. Do you suppose,’ the Walrus said, ‘that they could get it clear? I doubt it,’ said the Carpenter, and shed a bitter tear.” Lewis Carroll, The Walrus and The Carpenter

Why we underperformed in 2017

2017 was a tough year for the Pendal Wholesale Asian Share Fund. I’ll recap the main reasons for the underperformance, not just so that I have it in one place (I’ve commented on some of the mistakes in my monthlies last year), but also for me to reflect on and explain what I’ve done to the portfolio since.

As you are aware, I do own cyclical businesses in our portfolio. However, compared to the index, which has perhaps a 40-45% weighting, I own no more than 25%. In 2016, I had started increasing my cyclical position closer to 20-22%, but in a year like 2017 with a huge cyclical-biased rally, I will underperform. The reason I own cyclicals is to lessen the underperformance during a cyclical recovery. Shares of quality and defensive-oriented businesses generally do not perform as well in a year in which we have cyclical rallies. Some clients have asked if I would increase the weighting in future to mitigate this risk. It’s unlikely for the simple reason that cyclical turns are macroeconomic events and therefore difficult for me to predict. In my opinion, cyclical stocks do well (most of the time) because of a change in risk perception, not because they are good businesses to own.

In my opinion, cyclical stocks do well (most of the time) because of a change in risk perception, not because they are good businesses to own. Samir Mehta – Senior Fund Manager, J O Hambro Capital Management

Unfortunately in 2017, the timing of my stock-specific mistakes in my core holdings coincided with the powerful cyclical rally. In the past when I’ve made mistakes, they were usually compensated by my other stock holdings performing equally well or better. That was not the case last year. Not just the cyclical rally but its narrowness played against me as an all-cap fund.

Tilting towards financials and materials

As to the current portfolio, you will observe that I made a reasonable tilt towards the financials and materials sectors in 2017. In the past, both were poorly represented in our fund. Financials should generally benefit from low valuations, falling risks on non-performing loan (NPL) provisioning, falling risk of regulatory fines, rising loan growth and possibly higher margins leading to sustained earnings growth. A sweet spot, if any could be defined. Materials, on the other hand, are benefiting from an anti-supply shock in China. In terms of countries, North Asia and select exposure to Malaysia and Indonesia reflect my confidence in the global economic recovery, as well as the possibility of this rally broadening out from the narrowness we experienced last year.

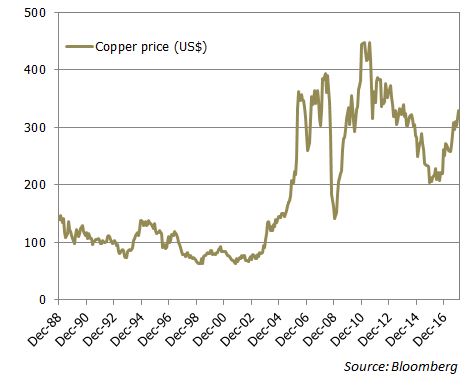

On the topic of materials, let me reflect on the events of the past two decades, which help put things in perspective. China’s accession to the World Trade Organisation in December 2001 was a watershed moment. Around that time, the US was dealing with the fallout of the internet bubble, while Asia was cleaning up after the Asian financial crisis of 97/98. The Greenspan-led Federal Reserve cut interest rates aggressively to counter slowing GDP growth. American corporates were keen to outsource to China in order to reduce costs. China’s vast land mass, cheap exchange rate and unlimited labour pool set in motion the long bull market in most assets from 2002/3 onwards.

I attribute a demand shock from China to be one of the foremost reasons for that bull market in commodity prices. As China’s economy grew, capital flooded in, infrastructure investments picked up; cheaper and easier access to credit fuelled a concurrent rise in consumption as well. Some people compared it with Japan’s industrialisation, only much bigger in scale. In the early 2000s, as global growth went on steroids, commodity prices in particular rose very sharply. Of course, that was before it all nearly ended with the 2008/09 crisis.

Copper is the new gold

Too much stuff

A supply response did emerge for commodities and metals. Most projects planned and implemented during the boom fructified between 2008 and 2013. Commodity prices remained elevated after the 2008/09 crisis, thanks in no small measure to the gigantic stimulus plan by China and the QE policies of central banks across the world. However, by 2013, as the Federal Reserve spoke about ‘normalising’ policy and the effects of the stimulus started to wear down, excess supply was in plain sight. What was once a demand shock was now blighted by supply excess. Everywhere you looked, just like the Walrus and the Carpenter, you could see just too much stuff. China’s severe downturn in 2015/16 gave rise to the possibility of widespread deflation. As industrial China floundered, the country’s banking system came under stress.

In my view, the Fed’s decision not to raise rates in March 2016 was in hindsight the pivotal turning point for China, the global economy and commodities in general. It allowed the Chinese authorities breathing space to deal with capital outflows that were snowballing into capital flight. Subsequently, a clampdown on outflows and a bit of economic stimulus helped stabilise demand. Regardless, the added positive for commodity prices has been a desire to control pollution in China and the associated supply side reforms. This has led to a significant shut down of capacities in steel, cement, coal and aluminium, in particular.

A Chinese supply-side shock

The dictatorial fiat – what in normal times is considered anathema to capitalism – was in this case a boon for capitalism. We know that in North Asia (Japan, Korea and China) businesses were driven more by market share ambitions rather than by generating the highest return on capital for their shareholders. This attitude, combined with cheap access to capital and the state’s desire to grow GDP at any cost, resulted in over-investment in several industries. If the Chinese government does maintain its focus on pollution, which then translates into more discipline on future expansion, the result will be lower GDP growth (as fixed asset investments grow at a slower pace) but much better cash flows and profits. A demand shock from China caused the first boom in commodities; ironically, an anti-supply shock from China is driving commodity prices higher now. So far, there is evidence that the clamp down on industries to reduce pollution, especially in and near the big cities, is genuine. Take the cement industry as an example.

Cement prices – at levels not seen for years

I started buying China’s Anhui Conch, one of the largest cement manufacturers, in March 2016 as part of our contrarian approach to cyclicals. As cement prices have climbed, profits for cement companies are running at levels not seen since 2011. Fear drove price-to-book multiples in 2016 to extremes; I’m hoping that greed will drive the price-to-book ratio to well above mean levels at a time of rising book values. If the government stays firm on capacity controls, that outcome is likely some time later this year, in my view. I’ll be happy to give the stock away to those who are fearless then.

Anhui Conch – fear no more

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at February 15, 2018. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

PFSL is the responsible entity and issuer of units in the Pendal Asian Share Fund (Fund) ARSN: 087 593 468. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1800 813 886 or visiting www.pendalgroup.com. You should obtain and consider the PDS before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.