George Bishay: Tailwinds for credit

Tailwinds for credit: portfolio manager George Bishay (pictured) of Pendal’s Bond, Income and Defensive Strategies team will discuss this in the article below.

Credit markets had a strong quarter following the chaos of March. A number of key policy decisions taken by central banks in mid-March provided a bedrock for a strong recovery in credit spreads. We also saw somewhat better health and economic outcomes through May and June –particularly in Australia. However these are being tested in July.

The Reserve Bank introduced Yield Curve Control in mid-March, anchoring 3-year rates at 0.25% for at least three years. This started a grab for yield – or as bond managers call it, “carry and roll”.

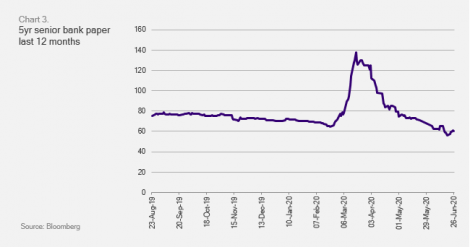

Bonds with maturities fewer than five years across the spectrum were huge beneficiaries as one element of uncertainty was removed. The RBA also started a Term Funding Facility (TFF) for banks, providing 3-year funding at a super-cheap 0.25%.

There are limits on this, but it has removed the banks’ need to issue term funding for the rest of the year. The take-up of the RBA’s TFF has been gradually increasing over the quarter, with total drawdowns to date of just over $A12 billion out of a total funding allowance of $A135 billion.

Bank spreads are now tighter than before the crisis, providing a knock-on effect to other credit sectors.

The third measure the RBA took in April was to widen repo eligibility to include senior AUD issued investment grade credit. This stopped short of the actual buying of corporates which a number of other central banks undertook. But the impact gave another strong tailwind to credit spreads.

This has seen spreads between non-financial bonds and financials widen compared to historical levels. The typical spread of 20bps is now sitting at 60bps as lower bond issuance combines with strong demand for higher-rated banks bonds.

These three RBA policy decisions were seen as part of a “whatever it takes” mantra by global central banks and governments. In past decades we’ve had the Greenspan put, the Bernanke put, the Yellen put and now clearly the Powell put. For Australia you can throw in the Lowe put.

The perception is that if conditions deteriorate again central banks will have your back. As Virgin Australia discovered it is not limitless. But for key locally-owned firms in significant industries, being part of Team Australia has its benefits.

Governments around the world are also deploying significant fiscal packages to support employment and stimulate economies. These have encouraged equity and credit markets.

In the medium-term the focus of markets will switch back to the underlying credit fundamentals of companies.

Many companies across the globe improved their credit quality by raising equity to support their balance sheets. We have favoured those companies keen to keep gearing under control and protect their credit rating in the face of potential asset write-downs. We are also watching closely the dynamics from this crisis impacting different sectors in the long term. There is no doubt the world has changed, which will bring permanent damage to certain industries.

The Australian iTraxx index (Series 33 contract) traded in a very wide 115bp range finishing the quarter 87bps tighter to +88bps.

Physical credit spreads were generally narrower, on average tightening 18bps for the quarter. The best-performing sectors were domestic banks, telcos and supranationals narrowing 57bps, 45bps and 19bps respectively. The worst-performing sectors were infrastructure and Real Estate Trusts (REITs) which widened 32bps and 13bps respectively.

New issuance picked up in May and June. Brisbane Airport (BBB) launched a 6-year and 10.5-year tranched deal. The book received $1.75 billion in orders over both tenors and $850 million of bond issuance. On the back of strong demand and attractive pricing the 6-year and 10.5-year tranche pricing tightened 35bps during the offer.

Other issuance in the corporate bond market included Westlink M7, the 50% Transurban-owned entity that operates the M7 concession around Sydney. It issued $155 million in 10-year bonds. The deal was 7.6x over-subscribed which saw its pricing tighten from first indication of 225bp to 215bp. It ended at 185bp. Singtel Optus got in on the action with a 5-year and 10-year bond issuance for a total of $850 million on a total book of $2.8 billion (3.2x over-subscribed).

In the supra-national space the National Housing Finance and Investment Corporation returned to the market with a very successful $562 million 12-year social bond. An Australian government guaranteed issuer, it came at 38 over Australian Commonwealth Government Bonds and is now trading at 18 over.

Overall most credit outperformed government bonds, helped by swaps spreads going further under government bonds.

Our outlook is still positive. However we remain cautious with the slowing pace of spread-tightening as we test multi-year tights in some sectors (domestic financials). Uncertainty stills exists in other market sectors.

Bid-side liquidity has significantly improved. Bid offer spreads compressed as many banks returned to the market after an absence in March and early April.

The balance between technical factors – such as central bank support, driving spread performance and the longer-term impact of the virus and subsequent economic fallout – remain critical to the future performance of credit markets in the months ahead.

George Bishay – portfolio manager with Pendal’s Bond, Income and Defensive Strategies team.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Find out more about our investment capabilities:

https://www.pendalgroup.com/about/investment-capabilities

Contact a Pendal key account manager:

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at July 31, 2020. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.