European and US industrials forge ahead, Boeing’s dreams come to life, and the price of convenience

In the weeks leading up to Easter, the Pendal Concentrated Global Shares Team completed its latest round of due diligence which took the team to parts of Europe and the US to review companies involved in various industrial functions, energy, financial services, real estate, and consumer goods. This trip provided the team with the opportunity to identify new investments, stress test existing portfolio positions, and confirm the underlying tenet of our portfolio that the global economy has reached an inflection point remains intact.

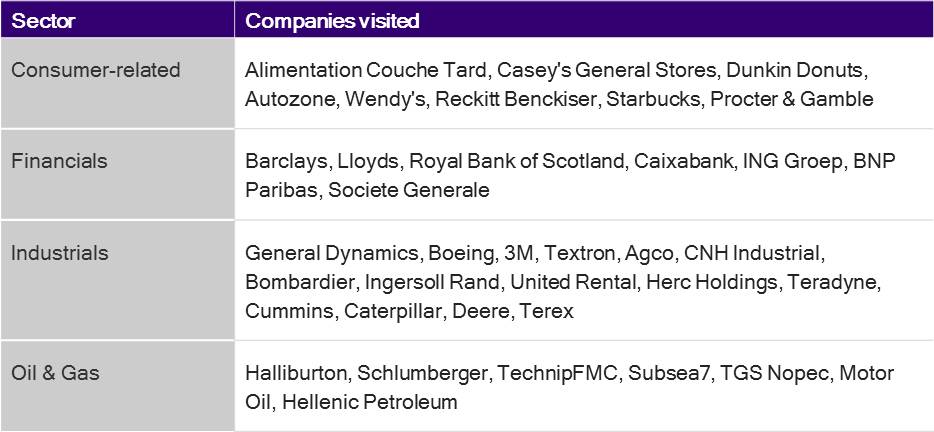

Company meetings – March-April 2018

Our meetings did very little to dispel our belief that the global economy remains on a path of growth. Interestingly, no group of companies were more positive than the industrials, despite President Trump’s tariff impositions, which evolved from rhetoric to reality during our trip. From the humble tractor maker to the builder of aircraft, confidence was shared by all and stems from the fact that much of the demand to date has related to replacement rather than expansion, with any over-enthusiasm being kept in check by a supply chain struggling to keep up. Quantitative measures such as equipment pricing, rental rates, and backlogs are all trending favourably and are supportive of the view that growth will extend beyond what is shaping up to be a very strong 2018. While a lot of the industrials space has already re-rated, opportunities remain and we look forward to sharing these in due course.

With regards to the businesses already in the portfolio, the trip left us comfortable with our ownership of Boeing, despite the value of the company having doubled over the past year. We believe the quality of the business continues to be underappreciated by many in the market which, under the leadership of CEO, Dennis Muilenburg, has been re-engineered to become a more responsible allocator of capital and generate persistent growth in free cash flow. Since our last update, Boeing has continued to make solid progress in its key aircraft program. The company is continuing to grow its order book and has committed to increasing the production of 787 aircraft from 12 per month currently to 14 per month. Boeing recently delivered the inaugural 787-10 to Singapore Airlines and continues to undertake due diligence on the much anticipated ‘middle of market’ airframe.

New portfolio investment

The latest addition to the Pendal Concentrated Global Share Fund is Seven & I Holdings. This Japan-listed company exhibits many of the characteristics favoured by the team and our process. In this edition of our Global Research Trip notes we share our insights from recent site visits to the company’s US outlets and the opportunities we see for investors.

—————————————————————————————————————————————————————

Who is Seven & I Holdings?

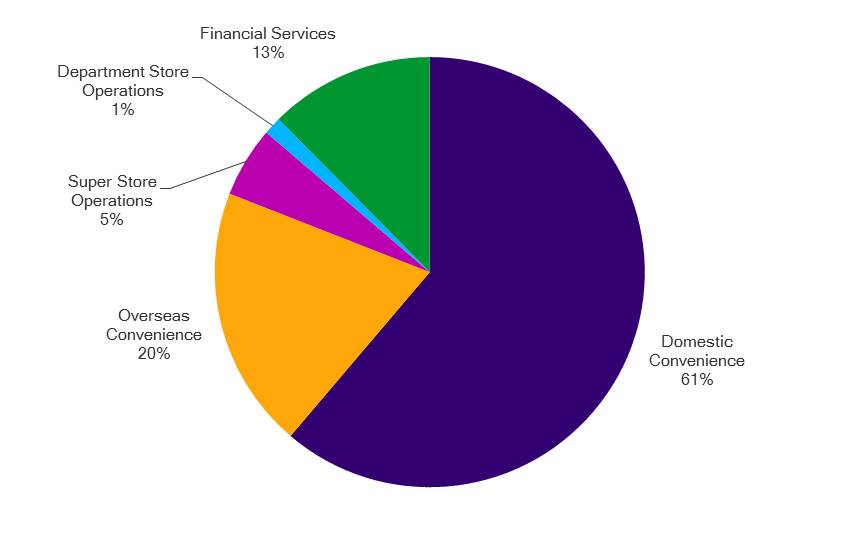

Seven & I Holdings (herein referred to as 7-Eleven) entered the team’s investment radar late last year during a research trip to Japan. The business operates/licenses/franchises stores under the 7-Eleven brand and is the leader in Japan’s convenience store (“C-store”) market. The company is building upon its 44% market share through a fresh food offering that resonates with the country’s demographic and lifestyle demands. Complementing the C-store business in Japan which makes up 61% of earnings is the overseas C-store business where 7-Eleven is a top player in the consolidating US market. The company also operates a profitable financial services business and a portfolio of shopping centres and department stores in Japan.

Seven & I Holdings (herein referred to as 7-Eleven) entered the team’s investment radar late last year during a research trip to Japan. The business operates/licenses/franchises stores under the 7-Eleven brand and is the leader in Japan’s convenience store (“C-store”) market. The company is building upon its 44% market share through a fresh food offering that resonates with the country’s demographic and lifestyle demands. Complementing the C-store business in Japan which makes up 61% of earnings is the overseas C-store business where 7-Eleven is a top player in the consolidating US market. The company also operates a profitable financial services business and a portfolio of shopping centres and department stores in Japan.

Seven&I Holdings – business overview

Why we invested in Seven & I Holdings?

We initiated a position in 7-Eleven at the start of 2018 after our initial due diligence revealed a business where the troubled performance of its non-core assets (i.e. department stores, supermarkets and shopping centres) was overshadowing the dominant position held by the Japan-based C-store business and the opportunities within a consolidating US market. The non-core assets of the business have been so overbearing that there is now a significant valuation disparity compared to C-store operators both in Japan and North America.

Japan retail sales growth by segment: 1998-2016

Source: Japan Ministry of Economy, Trade and Industry. Growth has been indexed; 1998 = 1.00

Under the leadership of CEO Ryuichi Isaka, we have confidence that the significant value we see in the business will be unlocked. Appointed in 2016, Isaka-san’s approach to the business can be summarised as one of capital discipline, having outlined a strategic mandate that has demanded smarter investments in the Japan C-store business, improve in-store execution in the US C-store business, and close or divest department stores and shopping centres. In his first year, Isaka-San closed four department stores and 11 shopping centres/general merchandise stores, with more to come under his five-year plan. Over time, the rightsizing of non-core assets will help further de-risk the business and re-focus investor attention to the company’s core competencies. In the interim we are paid to wait through a circa 2.5% dividend yield.

What we learned about the business from our US trip

As part of our initial due diligence it was suggested to us that the US C-store market is primed for consolidation, with more than 150,000 stores of which, 65% are owned by operators of fewer than 10 stores. The two biggest operators, 7-Eleven and Alimentation Couche-Tard, have less than 10% market share each and were expected to be benefactors of the impending consolidation.

Our visits to numerous C-store operators in the US confirmed the validity of the consolidation thesis. We observed a significant gap in execution between the independents and chains a gap that will only get wider as the chains make investments to differentiate and enrich their food offerings and improve their technology capabilities. With some independents already struggling to fund working capital (e.g. empty shelf slots), it’s likely they’ll be left behind in the current investment push.

Conclusion

Overall, we left the US confident of 7-Eleven’s strategy in the US. The growth trajectory is significant as the independent operators, who are struggling for capital, act as market share donors for the chain operators for decades to come, either organically or through mergers and acquisitions. Since buying the stock, it has outperformed the MSCI AC World ex-Australia (A$) Index by nearly 7% as it continues to gain market share from Japan convenience store peers, execute on cost efficiencies, and return non-core businesses to profitability. Continued execution on these fronts should help reverse the valuation discount to peers, which is in excess of 20%. Having served 7-Eleven in a range of roles since 2009, Isaka-san knows the convenience store business well and exhibits the commercial acumen to drive organic growth in a strident, yet sensible manner.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at May 23, 2018. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

PFSL is the responsible entity and issuer of units in the Pendal Concentrated Global Share Fund (Fund) ARSN: 613 608 085. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1800 813 886 or visiting www.pendalgroup.com. You should obtain and consider the PDS before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.