Our current views on emerging markets

While Emerging markets (‘EMs’) have underperformed Developed markets (‘DMs’) over the period 2011-2016, as we stand today there are clear and compelling opportunities in EMs. However, there are also countries facing stiff challenges and political malaise. The key is to be selective in what you own.

The challenges in EMs include central banks tightening – higher DM rates and less liquidity has historically been a headwind for those EMs with current account deficits (Latin America, ASEAN). Expectations about the pace and terminal value of the US rate cycle have been waning in recent months. Nevertheless, countries such as Brazil are battling to control the FX depreciation and inflation that has resulted from capital outflows. In several instances – again, like Brazil – this process is complicated by the political instability and populist backlash that can accompany an economic reversal. As we suspected, the market’s euphoria surrounding President Rousseff’s impeachment proved premature.

There are also those EMs who enjoy current account surpluses and who benefit from the improvement in growth implied by higher rates – notably the East Asian exporters (Korea, Taiwan).

Our current positioning:

• Buy global cyclical growth – especially in Korea and Taiwan

• Buy India for the domestic recovery

• Remain cautious on China as stimulus slows – own growth/consumer stocks

• Underweight Latin America – commodities, politics, economic malaise

• Avoiding Turkey; Mexico is looking interesting

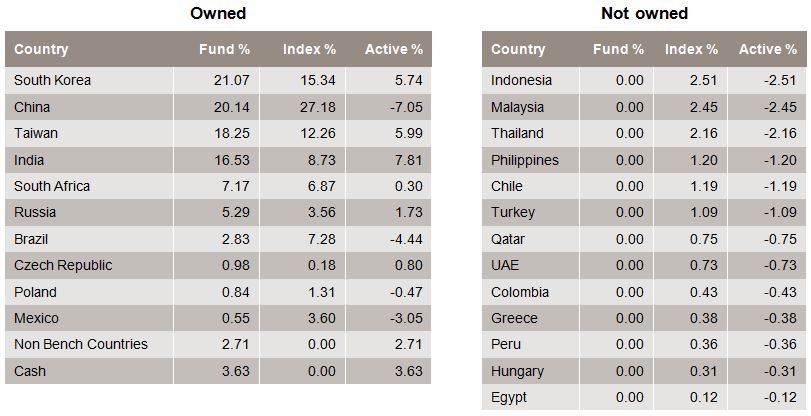

Figure 1 below shows the Fund’s country positions as at end May 2017. This demonstrates the high-conviction approach we take to country allocation.

Figure 1: BT Global Emerging Markets Opportunities Fund – Wholesale country allocation end May 2017

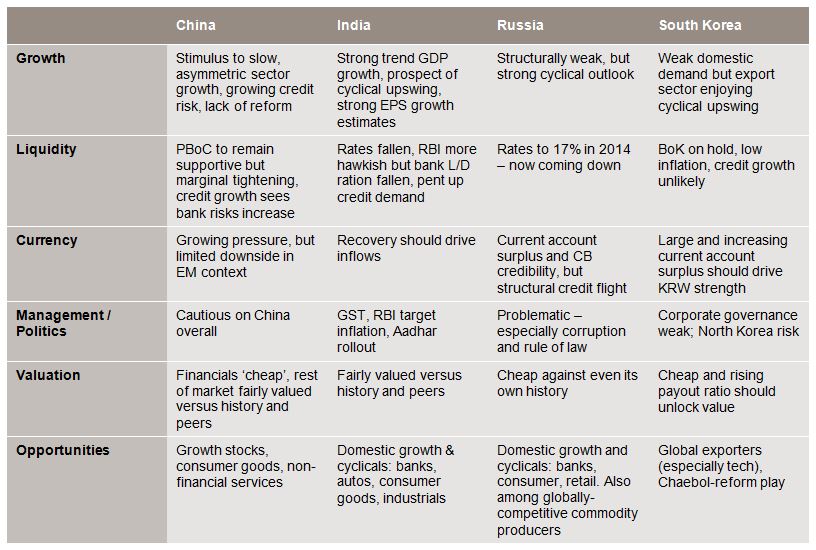

The table below demonstrates our current views on four countries within the context of our five-point framework: three of our largest overweight (India, Russia and Korea) and our largest underweight (China).

The key point is that EMs, given their diversity, do not perform in the same way in a given environment. As always, there are countries that look very attractive at these levels. There are also those that you want to avoid. This is why a country-driven approach is crucial.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at July 18, 2017. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

PFSL is the responsible entity and issuer of units in the BT Wholesale Global Emerging Markets Opportunities Fund (Fund) ARSN: 159 605 811. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1800 813 886 or visiting www.pendalgroup.com. You should obtain and consider the PDS before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.