Crispin Murray: what’s driving Australian equities this week

Here’s what’s driving Australian equities this week according to Pendal’s head of equities Crispin Murray (pictured above). Reported by portfolio specialist Chris Adams.

Find out about Pendal’s Focus Australian Share Fund here.

EQUITIES dropped and bond yields rose as markets tested policy makers’ commitment to keep rates lower for longer in the face of fiscal stimulus.

The pace of rising bond yields was material in a historical context. It implied the first rate rise would be brought forward to 2022. Central banks stepped in by the end of last week in a co-ordinated move to stabilise yields.

The challenge facing central banks is not so much how to drive yields lower again — but ensuring the pace of increases remains slow and controlled. The next few weeks will be a key test of their ability to do so.

The S&P 500 fell 2.4% to finish the month up 2.8%. The S&P/ASX 300 lost 1.5% for the week and is up 1.5% for February. The move in bond yields saw a further rotation from growth to cyclicals.

Reporting season ended up as one of the strongest in years including upgrades for F21 EPS from about 7% to 14%. This was driven by sharper bounces in earnings from resource-related stocks and Covid “winners” like retail.

That said, the latter were some of the worst performers for the month as growing confidence in the vaccine roll-out – coupled with the bond sell-off – dragged on momentum names.

In context of the overall market, the biggest shift in market expectations came from the banks. Expectation for FY21 EPS growth shifted from flat in January to more than 20% by the end of February.

We continue to expect equity markets to remain well supported following this period of consolidation, helped by good in-flows and strong earnings growth.

Covid and vaccine outlook

It is more of the same on the Covid front internationally. Countries rolling out vaccines continue to see falling new cases and hospitalisation rates.

Poor weather weighed a little on the rate of vaccinations. But in recent days the US has been nearing 2.3 million shots a day as the pharmacy network is brought into distribution. The approval of Johnson & Johnson’s vaccine — plus increased production of existing vaccines — has the potential to drive US to more than 3 million shots a day.

The UK’s program is also showing momentum. But European vaccination rates remain far lower, apparently due to greater public scepticism. This is likely to see Europe’s recovery lag the US. This could also act as a dampener on US bond yields. If the spread between European and US bonds widens we could see a shift in capital flows between them.

Policy and economics outlook

Bond yields are the current key issue. The bond sell-off is material in a historical context — particularly given its speed. It was exacerbated by a poor auction of US 7-year bonds, with the worst bid-to-cover ratio in ten years.

There are two factors to note:

- The increase in short-term rates indicates expectations of a first rate hike at the end of 2022. Expected rates for mid-2023 are now 40bps higher than they were at the start of the month. These expectations are well ahead of the Fed’s stated position. This effectively tests its resolve given the expected scale of growth coming through.

- The volatility occurred in real rates as opposed to break-even rates. The market is effectively saying they don’t buy real rates staying this low given the fiscal stimulus. The question is whether the Fed can hold its nerve as we see growth and inflation begin to rise.

One paradox was that inflation expectations actually started to roll over. This would be inconsistent with a continued rise in real yields.

The yield curve continued to steepen, which has been supportive for financials in the equity market.

We saw a bigger move in Australian bonds than US. This has taken our yield curve to its steepest in more than 20 years. The RBA increased Quantitative Easing to hold the 3-year yield. This worked, but also reinforced concerns about the 10-year yield.

We have seen a concerted effort by central banks to ease concerns in response to these moves. The issue for countries outside the US is that they are seeing the rise in yields, but do not have the same degree of stimulus as the US. Therefore the rise in rates is a negative for any recovery.

The Fed is the only central bank not to respond so far. But we’ve seen two new speeches placed in the diary: Lael Brainard pre-market open on Monday and Chair Powell on Wednesday. We expect both to be more explicit on not raising rates and not announcing specific bond market intervention yet.

In the near term the current extreme positioning in terms of bond shorts — coupled with Fed jawboning — could see a relief rally in bonds which would support a rotation back to growth.

Beyond this, we think the trend in US 10-year yields towards 2% will remain in pace. The Fed’s aim is not drive to yields down from here, but to make sure the increase is gradual and orderly.

A continued accelerated surge in yields would be an issue for equity markets. But we believe the underlying data will allow the Fed to maintain its current approach, rather than being forced into a dramatic U-turn.

Markets

Equities sold off last week, led by growth stocks. US 10-year bond yields stabilised to end last week up only 7bps — but they are up 34bps for the month. Australian 10-year yields rose 48bps for the week and 78bps for the month.

There was strength in commodities as an inflation hedge. Brent crude was up 6.3% and copper 4.3%. If we do see a relief rally in bonds we could see a near-term reversal in commodities.

The rotation from value to growth — when seen via proxies such as US regional banks (value) and Cloud-tech ETFs (growth) — had a move of similar scale to November’s, when the first surge in vaccine optimism occurred. Banks may be due a pause here following strong gains.

Equity fund inflows across the globe have remained very strong. US$414 billion has flowed into equity funds in the past four months, dwarfing anything seen since the GFC. This — along with solid corporate earnings — should help support the market if we see a stabilisation in bonds.

Reporting season

Overall it was a strong reporting season. FY21 EPS growth increased from +6.9% at the start of February, to +14.8%.

The ratio for companies upgrading guidance by more than 5%+ to downgrading by 5%+ was two-to-one. It was the same for dividends.

Banks delivered the biggest surprise sector-wise. Lower bad-and-doubtful debts, better margins and volumes encouraged FY21 earnings growth expectation to climb from 0% earlier in the year to more than 20%.

Our preference here remains Westpac (WBC) and ANZ (ANZ) which have the greatest leverage to positive trends.

Stock-wise reporting season was very much a story of inflation hedges and less-loved stocks turning the corner while tech, gold and high-performing retailers all got hit.

Crispin Murray is Pendal’s Head of Equities. He has more than 27 years of investment experience and leads one of the largest equities teams in Australia.

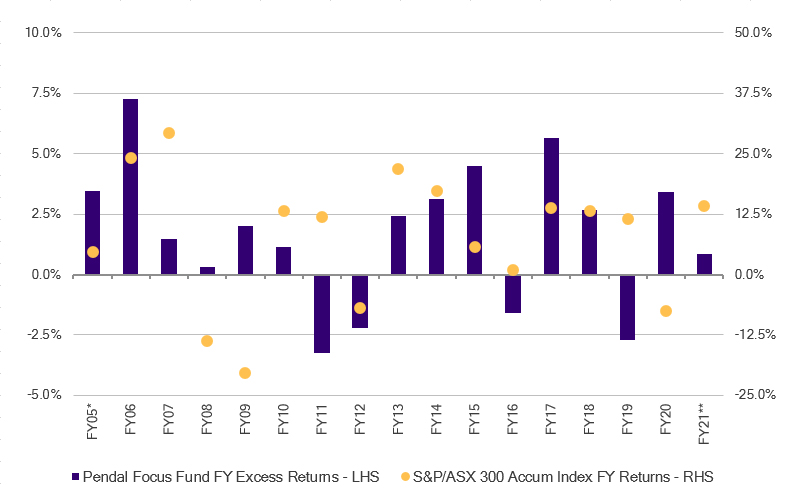

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions , as this graph shows:

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at March 01, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.