Crispin Murray: What’s driving Aussie equities this week

Here’s what’s driving Australian equities this week according to Pendal’s head of equities Crispin Murray (pictured above). Reported by portfolio specialist Chris Adams.

- Crispin Murray names the big policy shifts driving equities

- Find out about Pendal’s Focus Australian Share Fund here

EQUITY MARKETS shrugged off concerns over rising Covid cases in the US and in Europe to deliver further gains last week.

The theme of stronger growth — underpinned by yet more encouraging data from the US — seems to be winning.

While there was disruption in the wake of failed hedge fund Archegos, it was felt mainly at a stock-specific level rather than as a broader market event.

The S&P/ASX 300 delivered a 0.63% gain last week, while in the US the S&P 500 was up 2.8%.

Covid and vaccine outlook

There are some localised surges in new Covid cases in the US. Michigan provides a case in point. The 7-day rolling average of new daily cases there has almost returned to the peaks of Q4 2020 as the UK strain spreads. Nevertheless, a national bounce in cases remains relatively muted.

Europe is still struggling to contain a rebound in cases, though there are early signs the surge may not be as bad as previous waves. The impact on sentiment is ameliorated by stronger economic data.

There is a pick-up in the US hospitalisation rate. But at this point the consensus is this will be a mild wave which will not require significant new restrictions. This risk does need to watched, however, given the market’s current appetite for re-opening stocks.

Vaccinations in Europe have begun to step up and are on course for 50% penetration by July.

US vaccinations continue to break new records and are now running at 2.7 million shots a day. Vaccine production capacity is set to rise 50% in April, allowing further acceleration. Almost 40% of the population has been vaccinated.

Economic data remains strong

Economic data continues to demonstrate the strength of the US economic rebound. March payroll data showed 916,000 new jobs versus a consensus expectation of 660,000. Payroll data for the previous two months was also revised up 156,000.

Total US employment, having stalled in recent months, is now accelerating again. The pace of recovery is in stark contrast to post-GFC. It took five years for employment to regain pre-GFC levels. At the current rate, that mark would be reached in 2022. This underpins our view that current policy settings are partly a response to the perceived economic and social failures of the response to the GFC.

There remains a large gap with pre-Covid employment — about 11 million jobs. This helps hold wage inflation in check for the short-term at least.

But if the recovery continues at its current pace it is hard to see the Fed holding to their stated position of no interest rate increases until 2023.

Consumer spending is strengthening in the wake of stimulus payments. In the April 2020 stimulus round, recipients spent about 65% more at the peak than those who did not receive a cheque. In January 2020, the peak rate was only about 30% more. This package looks more like the first one — peaking in the week following cheques at around 58% more. Consumer confidence indicators are also breaking higher.

The US Purchasing Managers Index (PMI), a gauge of sentiment in manufacturing and services, remains elevated at around 65 (on a scale of 1 to 100). The record is 70, achieved in the mid-1980s. Business confidence in Europe is also rising according to surveys, despite a surge in new cases.

More detail emerges on US policy

The Biden administration revealed more detail on the proposed infrastructure package, “The American Jobs Plan.”

It proposes US$2.2 trillion spending, largely in line with consensus expectations. Traditional “hard” infrastructure would account for US$1.7 trillion. The remaining US$500 billion would be allocated to social support policies to address issues such as inequality.

The near-term impact is likely to be less muted than the headline figures suggest, given the spending is extended over a number of years.

Debate over how it is funded — given the need for higher taxes — will be a key area of focus in the near term.

Market outlook

There was some concern that banks selling down positions to help cover the impact of failed hedge fund Archegos would trigger a broad market impact in the vein of Long Term Capital Management (LCTM) in the late 1990s. Total losses from Archegos look to be US$6-8 billion and have hit a number of banks very hard.

Some second-order effects may emerge. At this point associated sell-downs have been seen in specific stocks, but have not destabilised the broader market. The off-setting effects of abundant liquidity and confidence in recovery are holding sway.

Market breadth remains a supportive factor for equity markets. Some 94% of stocks in the S&P 500 are above their 200-day moving average. This is more than at any point since May 2013.

This doesn’t mean we can’t see a correction or consolidation – but it makes it less likely that we are at a market top. A typical sign of extended market tends to be narrower and narrower markets in terms of drivers – and we are clearly not at that point.

Inflation remains the key risk that can de-rail markets.

There are signs of inflationary pressure in specific areas in supply chains. The issue is how quickly – and to what degree – this flows through to wages. The link to wage inflation has not been present for the past 20 years – and we are a long way from employment capacity. Nevertheless, this remains an important factor to watch.

Bond yields edged upwards in the US. The 10-year Treasury yield rose 4bps to 1.67% on the back of stronger economic data. The Australian equivalent rose 16bps to 1.84%.

The US dollar rose another 0.4% as measured by the DXY against a basket of currencies. It is now up 3.3% over the year-to-date, helped by the strength of recovery relative to places such as Europe.

This has weighed on commodities in recent months, although iron ore gained 3.9% last week. Brent crude also rose — up 4.7%, helped by signals that OPEC would continue to be restrained in supply in response to increased demand.

Australian equities recap

Cyclicals such as Materials (+2.7%) and Industrials (+1.6%) tended to outperform on the ASX last week. Confidence in re-opening persisted despite a snap lockdown in Brisbane.

Construction-related stocks continued to perform well on strong housing demand. BlueScope Steel (BSL, +7.4%), Boral (BLD, +7.1%) and James Hardie (JHX, +6.4%) were among the best performers in the ASX 100.

Miners also caught a bid. Mineral Resources (MIN, +6.9%), which has exposure to both iron ore and lithium, was the best of them in the ASX 10, followed by Alumina (AWC, +5.0%), South32 (S32, +4.8%) and Fortescue (FMG, +4.3%).

AGL (AGL, -6.3%) was among the worst performers. It seems the more the market worked through the detail of the proposed demerger, the more it highlighted the limited value in the stock at current levels.

Tabcorp (TAH, -3.5%) gave back some recent gains as it announced a review of its business, potentially delaying a break-up off the company and possible sale of the wagering business. At this point we still expect a demerger of the lotteries and wagering business to be the most likely outcome.

About Crispin Murray and Pendal Focus Australian Share Fund

Crispin Murray is Pendal’s Head of Equities. He has more than 27 years of investment experience and leads one of the largest equities teams in Australia.

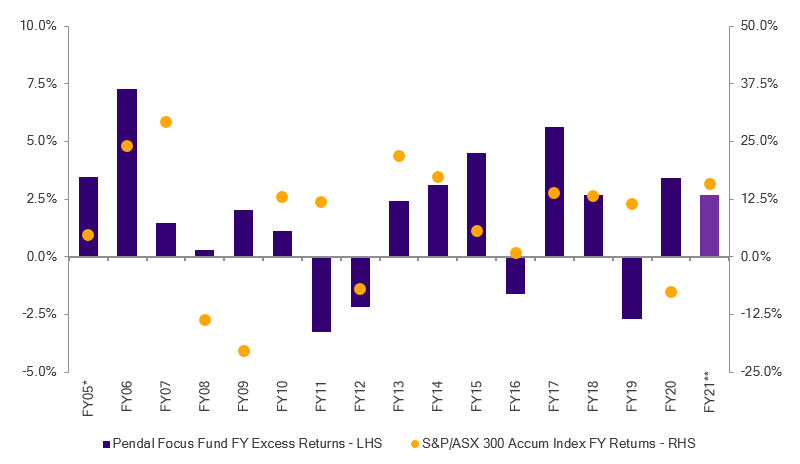

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions , as this graph shows:

Source: Pendal. Performance is after fees and before taxes. *From 01 Apr 05; **as at 28 Feb 21. Past performance is not a reliable indicator of future performance.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Find out more about Pendal Focus Australian Share Fund here.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at April 06, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.