Act like you own the joint

Does ownership of shares by a company’s senior leadership actually align interests and drive better results? And what is a true measure of alignment anyway? In our experience, effective alignment actually goes beyond having financial incentives in place.

A true sense of alignment requires a mindset that engenders belief in the long term success of a company.

The words of Texas Instruments’ CEO last month are particularly poignant in this regard and characterise his inherent mindset.

“To me, at the highest level, it’s a philosophy or a belief of a couple of things. First it is act like owners, owners that are going to own the place for decades, and then when you get inside of that you start to look at and make sure you’re focused on getting stronger, and not just bigger … and in many ways. We spend a lot of time on this internally, if you’re focused on getting stronger and you’re aimed at the right markets, the result is you will get bigger”

Rich Templeton

CEO, Texas Instruments Inc

Source: Sanford C Bernstein Strategic Decisions Conference, New York, May 27th 2019

Although a company is never immune to the economic cycle, the Texas Instruments leadership team exhibit complete ownership of the business strategy to ensure it is able to ride through the difficult times.

Texas Instruments is the world’s number one analogue semiconductor company which forms the nucleus of our many and varied connected devices. Its leadership offers a prime example of the owner-operator mindset we look for in company management.

One of the key tenets of our very different approach to investing is to apply this lens on a company’s management. Through time we have found a high degree of success in backing company management teams that exhibit an owner-operator mentality. This goes beyond any financial incentives in place as it is an indicator of a longer term sustainable growth mindset.

Texas Instruments is positioned for continued growth, with a highly diversified product mix skewed to the secular growth industries of automotive and industrial, where they operate across six and 13 sub-sectors, respectively.

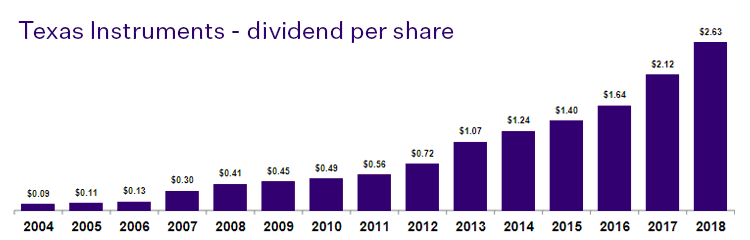

For the past 15 years we have witnessed success in this management philosophy. Through this time they have delivered, on average, double-digit growth in free cash flow and a dividend which has increased each consecutive year.

This kind of stewardship is at the core of its success.