Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Global equities: why it’s the 1960s all over again

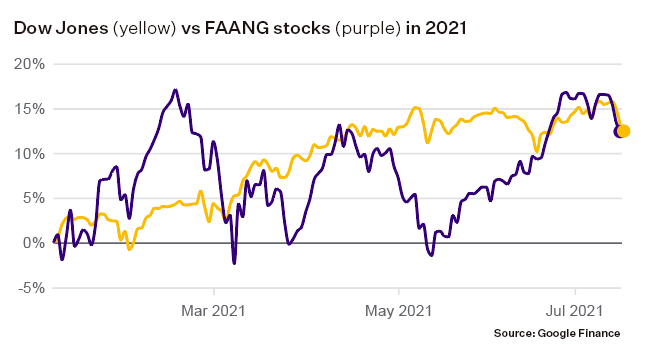

This year the Dow Jones has been keeping pace with the FAANG tech stocks — and even outperforming them. Pendal’s Ashley Pittard explains why global equities investors are looking further afield.

- Investors are looking to broaden their horizons beyond FAANG stocks.

- Inflation and wages are the critical variables.

- The world is normalising and that provides opportunities.

ASHLEY Pittard thinks the 2020s are a bit like the late 1960s and early 1970s. At least in equity market terms.

“Back then there were nice returns in equities. Inflation was increasing but it wasn’t out of control,” says Pendal’s head of global equities. “A limited number of stocks dominated the market.”

As equities appreciated in the late 1960s, and economies grew, there was a broadening out of the market, and investors looked further afield.

“The equivalent in recent years was the FAANG stocks. Everyone wanted them. But why they’ve underperformed over the last year is that growth has expanded into other areas. Commodities, for example,” Pittard says, likening the expansion to the movement beyond the “nifty 50” stocks of the late 1960s.

“What you are seeing now is that people want to own the growth stocks and rent cyclical stocks … but as the world normalises, people will be forced to own the cyclical companies.”

The big change over the past month was triggered by the US Federal Reserve.

“The Fed made it pretty clear that rates will go up and the market read that the risk of overheating had dramatically changed,” Pittard says.

It all evolves around the long-term dynamics of the market, Pittard says. Will inflation be higher over the next three to five years, than the last three to five years?

“I think it will. Interest rates are significantly lower than they have been over the past decade. Wage growth is now recovering and compounding at three to five per cent per annum,” he says. “In fact, you are seeing some fast-food companies paying up to $1,500 sign on bonuses for staff.”

“And if you look at house prices in the US, they’re at 30-year highs. House price growth is at 14.5 per cent.”

“It appears that things are getting in place for inflation to be over the Fed’s two per cent target number, and it won’t be transitory,” Pittard says.

Pittard’s fund on average only turns over 20 per cent each year. The fund managers spend time for looking for undervalued assets and waiting for them to appreciate.

“We like to buy the waterfront property when its trading at a discount and then we’ve got the patience to let things play out.”

– Ashley Pittard, Pendal’s head of global equities

Pittard gives the example of his fund increasing positions in Boeing following a series of accidents involving the 737 Max, and Airbus during the COVID crisis when airlines were on their knees.

“Today, the airlines have gotten rid of many of their old 747s, and the older pilots got axed. Now the US domestic capacity is back at 80 per cent, and recently United Airways said it wanted to buy 250 planes.”

The anecdote highlights that there are opportunities available if you are patient and can find assets that are under-valued because of the abnormal world in which we’ve been living.

“Our core tenant … is that the world is beginning to normalise. Around the world, people are starting to go out. There are fewer lockdowns and as a result people are spending more money on travel and eating out. Wage growth is getting back to normal. And that means there’s opportunities.”

About Ashley Pittard and Pendal Concentrated Global Share Fund

Ashley Pittard leads Pendal’s Global Equities investment boutique. He is responsible for setting the strategy, processes and risk management for the boutique and its funds including Pendal Concentrated Global Share (COGS) Fund.

Ashley has more than 24 years of finance experience, including roles in petroleum economics, global energy investment analysis and 20 years as a global equities fund manager.

Pendal COGS Fund is an actively managed, concentrated portfolio of global shares diversified across a broad range of global sharemarkets.

Find out more about Pendal Concentrated Global Share Fund

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Contact a Pendal key account manager here.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at July 21, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.