Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Investors and RBA still disagree on rates outlook. Here’s what we think

A weekly income and fixed interest snapshot from Pendal assistant portfolio manager ANNA HONG

It’s been a topsy-turvy week.

Monday started with the after-shocks of the latest Australian CPI print which featured core inflation numbers that convincingly beat forecasts.

The lead-up to Tuesday’s Melbourne Cup race at 3pm was unusually nerve-wracking as many in the markets waited for Governor Lowe’s statement at 2.30pm.

It marked the continuing removal of extraordinary monetary policy in Australia. As expected, the RBA announced the termination of Yield Curve Control.

Finally we had Friday’s release of the Statement of Monetary Policy (SoMP).

The RBA pushed back against market sentiment, which is pricing in a 2022 rate hike.

Find out about

Pendal’s Income and Fixed Interest funds

The RBA maintains its central scenario of a 2024 rate hike, though it will no longer defend the 0.10% YCC target for April 2024.

The key drivers of the scenario are unemployment and inflation. Unemployment was only marginally revised lower since the forecast scenario expects a gradual tightening of the labour market.

Inflation was revised upwards. But the inflation forecast has largely discounted surges experienced in other countries. The RBA says the impact of supply chain disruptions is less evident in Australian CPI.

But there is strong evidence to suggest otherwise.

Unemployment — one of the key lynchpins — has rebounded remarkably.

Businesses regained confidence and started hiring in late September, readying themselves for the end of lockdown.

In the foreseeable future, laggard industries such as accommodation, air & transport services and construction will very likely pick up as the economy continues to re-open.

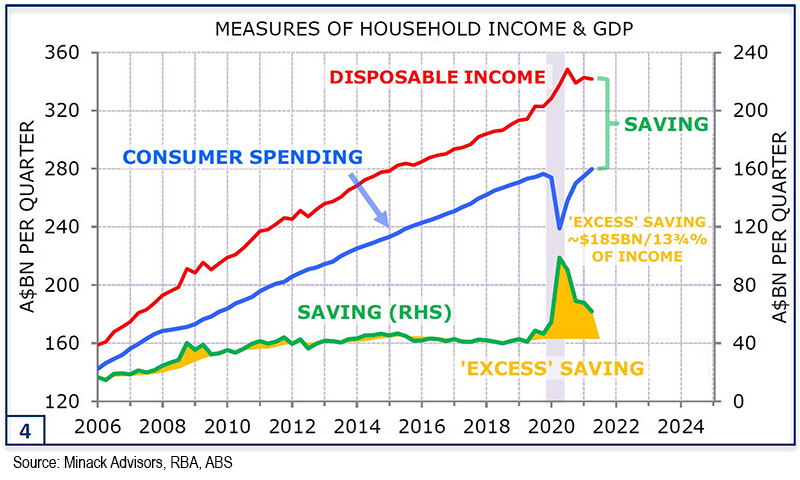

Australian consumers, flushed with cash, are on the same page as businesses.

The major banks are reporting that internal high-frequency consumer spending data demonstrates a strong recovery in consumer spending.

This may continue as disposable income grows and savings are unwound.

Market Implications

Even before the SoMP was released, the impact on housing credit could already be felt.

Westpac led the charge, raising fixed rate home loans by between 10 basis points (0.10%) and 21 basis points (0.21%). CBA followed with rate hikes to its home loan products, shortly after SoMP.

Before the SoMP, financial markets fully priced in a hike by July 2022 — with almost four increases priced by the end of 2022.

Markets eased off post-SoMP — but remained sceptical. Markets held firm to their pricing in of 2022 rate hikes.

Time will tell which side is right.

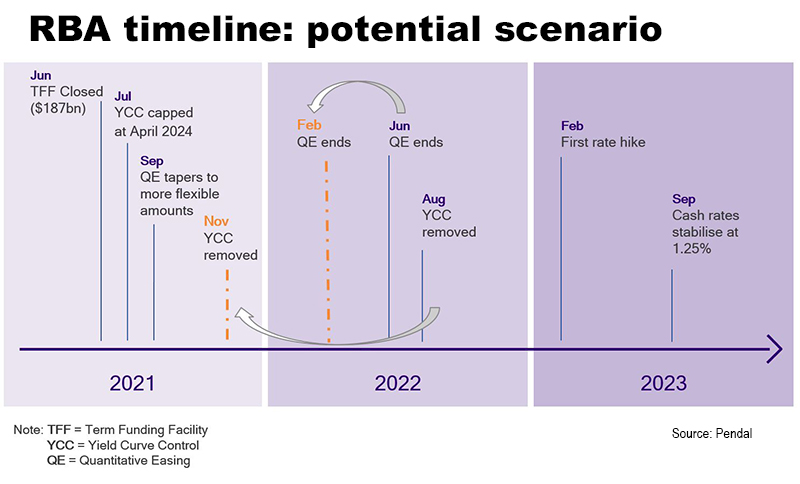

Here is Pendal’s time-line of potential RBA moves.

This timeline was first created in May. The arrows represent changes after recent RBA actions.

About Anna Hong and Pendal’s Income and Fixed Interest team

Anna Hong is an assistant portfolio manager with Pendal’s Income and Fixed Interest team.

Pendal’s Income and Fixed Interest boutique is one of the most experienced and well-regarded fixed income teams in Australia. In 2020 the team won the Australian Fixed Interest category in the Zenith awards.

With the goal of building the most defensive line of funds in Australia, the team oversees A$22 billion invested across income, composite, pure alpha, global and Australian government strategies.

Find out more about Pendal’s fixed interest strategies here

About Pendal Group

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current as at November 5, 2021.

PFSL is the responsible entity and issuer of units in the Pendal Monthly Income Plus Fund (ARSN: 137 707 996) and Pendal Dynamic Income Fund (ARSN: 622 750 734) (Funds). A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund.

An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.

For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com