Mainstream Online Web Portal

LoginInvestors can view their accounts online via a secure web portal. After registering, you can access your account balances, periodical statements, tax statements, transaction histories and distribution statements / details.

Advisers will also have access to view their clients’ accounts online via the secure web portal.

Global Equities: Two smaller European companies that look set to make an impact

- Find out about Regnan Global Equity Impact Solutions Fund

REGNAN portfolio manager Tim Crockford spends most of his time searching for companies with an innovative edge in solving the world’s biggest problems.

Right now the opportunities lie with smaller companies, he argues

IT would take nerves of steel to write-off US large-cap equities.

Trading at just below 20x price/earnings, the S&P 500 can be seen as either over-valued or under-valued, depending where you think the world is going.

Given the rally in Big Tech through the first quarter, quite a few investors would seem convinced that there’s life — and value — left in long-duration, large-cap growth.

But this feels like a belief that the future will replay the past.

Are there alternatives?

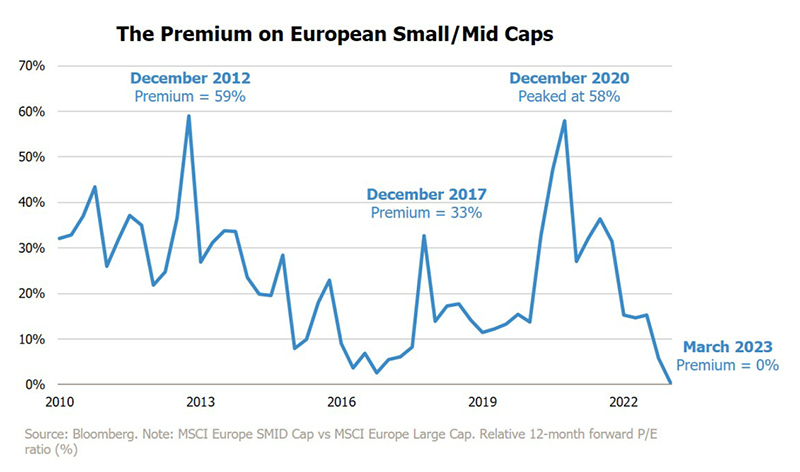

The chart shows the premium on European small and mid-cap relative to their large cap peers.

It is now approaching zero — the lowest it has been since the aftermath of the Global Financial Crisis.

We wouldn’t like to call the market.

But what we can do is identify opportunities in the European small and mid-cap area that we feel deserve serious consideration.

Here are two.

Alfen is a manufacturer of smart grid solutions that accelerate the energy transition.

It’s the only company in Europe combining smart grids, energy storage systems and electric vehicle (EV) charging systems into a single integrated approach.

A key growth market for the business is its range of smart-connected EV chargers, enabling the broader adoption of electric vehicles.

The prospective growth of EV hardly needs to be emphasised.

Ford Europe, as one example, expects to switch completely to electric vehicles in just two years.

Find out about

Regnan Global Equity Impact Solutions Fund

Stevanato Group has been operating for 70 years, most of that time manufacturing basic glassware.

Its current — and future — strength lies in “containment” technology.

This involves machinery that greatly accelerates the production of sterile medical equipment, particularly pre-filled syringes and vials used in high-growth biologic therapeutics.

About Tim Crockford

Tim Crockford leads Regnan’s Equity Impact Solutions team and is senior fund manager of Regnan Global Equity Impact Solutions Fund. Tim previously managed the Hermes Impact Opportunities Equity Fund after co-founding the Hermes impact team in 2016.

About Regnan

Regnan is a responsible investment leader with a long and proud history of providing insight and advice to investors with an interest in long-term, broad-based or values-aligned performance.

Building on that expertise, in 2019 Regnan expanded into responsible investment funds management, backed by the considerable resources of Pendal Group.

The Regnan Global Equity Impact Solutions Fund invests in mission-driven companies we believe are well placed to solve the world’s biggest problems.

The Regnan Credit Impact Trust (available in Australia only) invests in cash, fixed and floating rate securities where the proceeds create positive environmental and social change. Both funds are distributed by Pendal in Australia.

Find out about Regnan Global Equity Impact Solutions Fund

Find out about Regnan Credit Impact Trust

For more information on these and other responsible investing strategies, contact Head of Regnan and Responsible Investment Distribution Jeremy Dean at jeremy.dean@regnan.com.

This information has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and is current at May 2, 2023. PFSL is the responsible entity and issuer of units in the Regnan Global Equity Impact Solutions Fund (Fund) ARSN: 645 981 853. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1300 346 821 or visiting www.pendalgroup.com. The Target Market Determination (TMD) for the Fund is available at www.pendalgroup.com/ddo. You should obtain and consider the PDS and the TMD before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund or any of the funds referred to in this web page is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested. This information is for general purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation. The information may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information. Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance. Any projections are predictive only and should not be relied upon when making an investment decision or recommendation. Whilst we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections. For more information, please call Customer Relations on 1300 346 821 8am to 6pm (Sydney time) or visit our website www.pendalgroup.com