Crispin Murray’s weekly equities outlook: what’s driving the ASX

Here’s what’s driving Australian equities this week according to Pendal’s head of equities Crispin Murray (pictured above). Reported by portfolio specialist Chris Adams.

- Crispin Murray names the big policy shifts driving equities

- Find out about Pendal’s Focus Australian Share Fund here

TWO concerns emerged last week. Both bear close watching.

First was the emergence of another wave of Covid cases in Europe. The pace of vaccination has been too slow and Covid variants have taken hold, driving an increase in new daily cases across the EU. There are some emerging signs that the early removal of restrictions in the US may see growth in new cases in some states.

The second issue is growing scepticism over the Fed’s ability to keep rates low for an extended period, despite its reiterated stance. The risk here is of a sharp bond sell-off which contaminates equities.

At this point global equities continue to hold up well. But we note the oil price fell 7% last week. There is a risk this is the first sign of this year’s winning trades rolling over.

On the positive side, earnings continue to support markets. The US economy is taking off, while the Australian economy is doing better than expected — as evidenced by last week’s employment data. This can help sustain equities through a consolidation phase while the market adjusts to higher bond yields.

The S&P/ASX 300 fell 0.8% last week, while the S&P 500 was off 0.7%.

Covid and Vaccines

Overall new daily cases in the US continue to fall — but there are states such as Michigan and Florida where cases have turned higher. The arrival of Spring and the removal of restrictions is expected to lead to a new wave in cases. The issue is how material this will become given the level of vaccines and high levels of prior infection. Very high vaccination rates among the more vulnerable parts of society may mean far less pressure on hospitals.

Europe is more of a concern and a significant new wave is possible. There are renewed lockdowns in Poland and France. Non-essential businesses in Paris have been closed. Growth in concerns here are likely to have played a part in a weaker oil price over the week.

Economic and policy

The market’s essential paradox is that two-year inflation expectations in the US are nearing 3% — beyond the Fed’s 2% target — but the Fed’s guidance is for continued loose policy. The market is increasingly uncomfortable with this notion.

The Fed meeting this week reinforced this paradox with a message of more of the same. It re-affirmed a dovish perspective, with the majority of the FOMC seeing no rate hikes in CY22 and 23. The rationale is they expect strong near-term growth to fade, easing inflationary pressures. Their expectation is 2% inflation for CY22 and only marginally higher in CY 23.

The Fed appears to be comfortable with bonds finding a new long-term equilibrium and do not want to get in the way of it. The Bank of England also met this week and indicated comfort on rising bond yields.

The risk is that this process is not smooth and the sale of bonds becomes disorderly, given the unprecedented coincidence of strong pent-up demand driven recovery, fiscal stimulus and loose monetary policy.

The disconnection in expectations can be seen in the large spread between the Fed’s guidance and the market expectation of hikes implied in overnight index swaps (OIS). By the time the first rate hike is officially expected in Q4 2023, the market implied expectations are for three 25bp rate hikes — the first coming in early 2023.

This can also be seen within the FOMC itself. Five members are expecting three-to-four rate hikes by end CY23 — ie believing what the market is saying — while 11 see no such increases. The fact that this dichotomy exists even within the Fed suggests the market’s current expectation is plausible.

Economist and former US Treasury Secretary Larry Summers provided an interesting perspective last week. He repeated his observation that the US was plugging a 3-4% gap in GDP with 14% worth of stimulus.

He also noted a contradiction in the narrative that this is a new paradigm for progressive policies which will deal with structural challenges such as inequality and addressing climate change – but that the effects of the fiscal stimulus are transitory and will fade in CY22, meaning inflation is not an issue.

The key to this is how well inflation expectations are anchored. The Fed believes they are well anchored. The risk is that this belief is undermined and they are forced to re-anchor through a policy pivot.

This will be the key debate for the next six months. It could make for some choppy moments and heightened sensitivity to near-term signals. The strength of recovery in the US economy will be the key issue to watch.

We note that the basing out of the US dollar index may help with the management of inflation expectations. There are a lot of sectors correlated with the USD, notably resources. Recent USD strengthening partly explains the sell-off in resources stocks and remains an important factor to follow. We expect the USD can remain supported given challenges facing the EU. This could be a headwind for resources, but could also help check the worst fears on inflation and bonds yields.

On the US fiscal side, the focus is shifting to the tax increase which will come as part of the infrastructure bill. The Bill itself is still expected to be about US$2 trillion, with half towards hard infrastructure and the remainder to healthcare, education and research and development.

Half the funding is intended to be from net tax increases, including 28% corporate tax. There will be a lot of disagreement over tax rates within Congress, which may impede progress. But the headlines are likely to add to market concern.

One potential resolution may see the Bill broken up into a bi-partisan infrastructure Bill and then a second one that is more progressive and partisan incorporating tax increases.

We also got important Australian data last week. Employment data was very strong. The unemployment rate fell to 5.8% — 0.5% below expectations. This supports the view that any set-back from the end of JobKeeper will be limited and short lived, as long as no more lockdowns occur. The employment / population ratio is 62.3%, versus 62.7% pre-Covid.

The unemployment rate remains a little higher due to participation rates actually rising. Nevertheless Australia has effectively recovered all jobs and is well ahead of other countries in this regard.

Retail sales data was more subdued following a very strong run. It is a reminder that it is vulnerable to normalisation as opportunities emerge to direct spending to other areas such as domestic travel. The softness was more in the area of food sales, indicating people may be beginning to eat out of home more.

We also had population growth data for end of September which, unsurprisingly, has slowed dramatically. This will eventually begin to cause issues for economic growth and housing demand. But for now it will perhaps allow the unemployment rate to fall further and quicker than expected. We expect immigration will be high on the government’s agenda – and that the last 12 months have probably increased Australia’s attraction to potential migrants.

Markets

Equities continue to be resilient in the face of the bond sell-off. 10-year government bonds are on track for their worst quarter for returns in 50 years. Despite this equities in US are up 4.5%, helped by strength in corporate earnings.

The Australian market fell last week, mainly due to resources stocks falling in sympathy with commodity prices. There was a rotation to more defensive names. Over the calendar year to date resources are now underperforming. Banks are the clear lead sector, while tech is worst.

We saw some of the more speculative tech names affected, which is understandable given the rise in bond yields.

The market was led by stocks that had lagged more recently. Some of the US dollar-sensitive stocks did well. Retailers also recovered, as did gold miners.

There was some news flow on key positions in the portfolios.

Metcash (MTS, -2.5%) delivered a constructive strategy day. The IGA franchise has won market share as a result of changing shopping habits to more regional and neighbourhood centres. They have now moved back into store expansion, rather than closures, while Aldi’s roll-out has ended. This suggests they can hold share in this space.

Meanwhile hardware offers a decent growth opportunity in a consolidated industry. The stock fell in reaction to increased capex in this space, but we see the plans as sensible and likely to produce a reasonable return.

The company upped its payout ratio from 60% to 70%, which can be funded despite the capex and means the yield is running at 5%.

Gold miner Evolution (EVN, +5.1%) announced a mid-sized debt-funded acquisition of a Canadian gold company which is adjacent to their existing Red Lake mine. This and allows them to bring forward production and reduce capex, so was well received.

About Crispin Murray and Pendal Focus Australian Share Fund

Crispin Murray is Pendal’s Head of Equities. He has more than 27 years of investment experience and leads one of the largest equities teams in Australia.

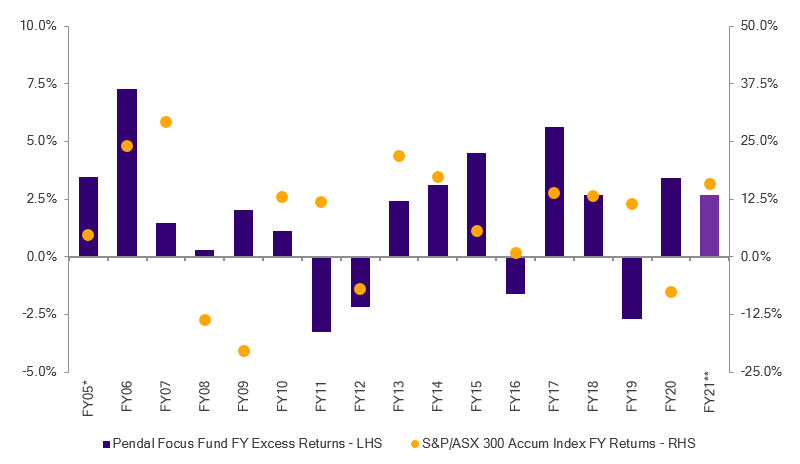

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions , as this graph shows:

Source: Pendal. Performance is after fees and before taxes. *From 01 Apr 05; **as at 28 Feb 21. Past performance is not a reliable indicator of future performance.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Find out more about Pendal Focus Australian Share Fund here.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at March 22, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.