Crispin Murray’s weekly ASX outlook

Here’s what’s driving Australian equities this week according to Pendal’s head of equities Crispin Murray (pictured above). Reported by portfolio specialist Chris Adams.

- Crispin Murray names the big policy shifts driving equities

- Find out about Pendal’s Focus Australian Share Fund here

RECENT trends persisted last week.

On the negative side new daily Covid cases rose in the US as mobility increased with the warmer weather. European numbers also continued to surge higher.

Bond yields were more stable, although there was more selling on Friday.

This is balanced with optimism around the stimulus and pent-up demand as vaccine penetration improves in the US and UK. There are also signs of the wealth effect supporting spending on housing market strength.

The bearish argument is that economic momentum peaks in the next month with strong growth already priced in and the emerging risk of another Covid wave affecting demand.

The bull case is that the market cycle continues, supported by a strong economy, even as the momentum of growth slows. This is supported by the notion that we are in the early phase of the recovery, with corporate earnings picking up and no sign of tightening.

We are in the latter camp at this point, though our portfolio positioning reflects our view that we must be mindful of material risks. We do think market leadership will continue to shift. We are already seeing the more speculative growth names continue to underperform in the US.

The S&P/ASX 300 gained 1.7% last week, while the S&P500 was up 1.6%.

Covid and Vaccines outlook

Localised outbreaks in New York, Michigan and Pennsylvania pushed up total US new daily cases by 8% week-on-week.

In New York an estimated 20% of cases are the E484K mutation (seen in the Brazilian and South African strains) which is less responsive to the vaccination. A further 40% have the B117 (UK strain) variant.

A variant-specific vaccine will be trialled in early summer and may be available by September.

The key risk is that case levels remain elevated due to these strains, which could impact sentiment and activity. This highlights the complexity of re-opening international borders later in the year.

It will be important to track US hospitalisations which tend to follow case numbers with a lag of one to two weeks.

Pressure on the medical system has eased and is not an issue now, given the penetration of vaccinations in the over-65 age cohort.

Vaccination rates in the US should ramp up with increased supply, allowing jabs for 3-4 million people daily. It’s expected that two-thirds of the US population will be vaccinated by the end of April.

Europe’s vaccination rate is now running two months behind the UK. Daily vaccination rates are trending down in France and Germany and rising cases are leading to further lockdowns. This is affecting markets, weighing on the price of oil. Continued issues in Europe could also help support the US dollar and bond market.

Economy and policy outlook

April could be the strongest month for US economic growth that we see in our working lives.

The effective stimulus distributed in March is the equivalent of payments in April 2021. There are signals of strong pent-up demand while the surge in equities and house prices is contributing to the wealth effect.

All this is very supportive of likely consumer spending, underpinning corporate earnings. Data is likely to be strong, perhaps bringing more pressure to bear on bonds.

As this initial surge passes, the question is whether it will signal a temporary high in bond yields. If so, we are likely to see some rotation back to yield-sensitives in the equity market. This is an important question in terms of portfolio construction.

There was debate over the US infrastructure Bill last week with a desire to put more longer-dated stimulus in train to help offset the drag as the current packages expire next year. At this point there is talk of US$3-4 trillion spread over ten years. This may be put to Congress in two packages.

One package could focus on mainly physical infrastructure, which would likely attract bipartisan support. The other, more progressive package could focus on other equality-focused measures and be passed via the budget reconciliation process.

We are also keeping an eye on the debate over tax, which has implications for earnings and specific sectors. The Biden tax proposals equate to about US$2 trillion, including an increase in the corporate tax rate to 28%.

If fully implemented these measure would be a 6% hit to S&P500 earnings.

There are also initiatives to change taxation for companies earning offshore, which may surprise the market. Pharma companies are likely to come in for specific proposals.

Higher taxes are coming but the current package is likely to be watered down. The corporate rate may be lifted to 24-25% with end impact closer to 3-4% of corporate earnings.

Debate over the filibuster is shaping up as a major issue in the US.

If materially watered down this will open the door for far more Democrat policy agenda — leading to greater spending on environmental issues and higher regulation. This could lead to higher US bond yields and a weaker USD.

Markets outlook

US 10-year government bond yields stabilised last week, though they rose on Friday after chatter about further stimulus measures. The USD continues to grind higher, encouraging some rotation to more defensive names.

Currency strength and stable yields are potentially driven by the carry now available in US bonds for foreign investors, given the low cost of capital.

We see a battle emerging between this liquidity support versus the reality of growth and rising inflationary pressure.

The virtuous circle of liquidity that helped support speculative tech names in the US may be unwinding. It looks as though not as much of the stimulus is being invested in the market.

People are also getting outside, meaning there’s less time to day trade.

The proxy here is the ARK Innovation ETF — and by association Tesla — which are down 27% and 30% respectively from their highs. ARK in particular could be hit hard if outflows accelerate.

Australian equity strength was broad based last week. We saw more high-quality defensives join the rally, having lagged year to date.

TPG Telecom (TPG, -7.4%) was the weakest stock in the ASX100 after news that founder David Teoh was stepping down as Chair. The reason was not disclosed. He retains a 17% stake in TPG, with 80% of this held in escrow until the end of June 2022.

Teoh is regarded as the architect of TPG’s historically aggressive approach on pricing. So the news was seen as a positive for Telstra (TLS, +6.3%), which was one of the market’s strongest performers. TLS also outlined a new corporate structure which will enable it to partially or fully divest infrastructure assets such as its mobile towers. This could potentially free up capital for share buy-backs.

Crown Resorts (CWN, +19.6%) received a takeover approach from private equity firm Blackstone and was the best performer in the ASX 100.

Blackstone’s offer is highly conditional and opportunistic in nature. The bid is only in line with the stock’s pre-Covid level. Blackstone is taking advantage of a discount related to the regulatory reviews — but it is conditional on the resolution of those issues.

The market’s view is that this is designed to flush out a joint venture partner that could buy in combination with Blackstone at a higher price. While the bid highlights the under-valued nature of CWN’s attractive assets — which forms part of our investment thesis — there is still a fair bit of water to flow under this bridge before a deal is finalised.

Small cap tech company Pushpay (PPH, +8.7%) — in which we also invest — rose as one of the early venture capital backers sold a block of stock equivalent to 15% of the float to US tech fund manager Sixth Street Advisors. This removed a significant overhang and brings in an investor with a strong track record in backing the likes of Air BNB and Spotify.

Xero (XRO, +6.1%) made a small bolt-on acquisition ($25 million) of Swedish e-invoicing company Tickstar. This is a sensible move in line with the company’s growth strategy in our view.

Among other stocks we invest in, Metcash (MTS, +6.6%) was one of the quality defensives to catch some interest last week.

James Hardie (JHX) rose 5.7% as bond yields stabilised. Anecdotes from US homebuilders remain supportive, suggesting sales could double current levels if supply was available. At this point the prospect of higher mortgage rates is not having a negative impact on demand. Builders are also signalling an opportunity to raise prices further.

About Crispin Murray and Pendal Focus Australian Share Fund

Crispin Murray is Pendal’s Head of Equities. He has more than 27 years of investment experience and leads one of the largest equities teams in Australia.

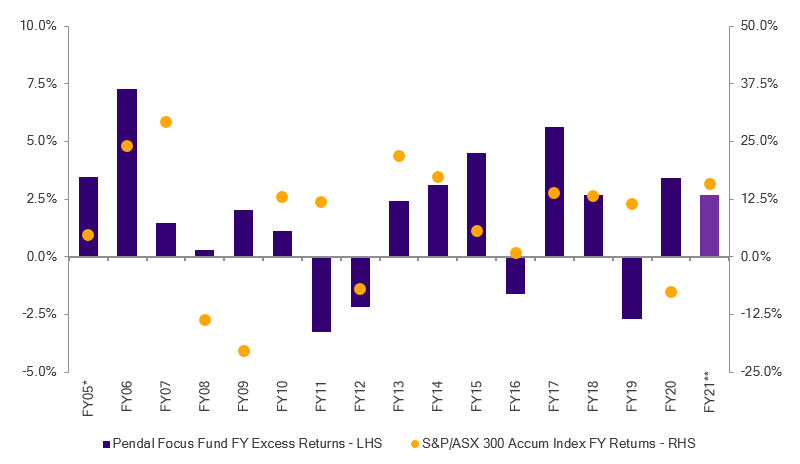

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions , as this graph shows:

Source: Pendal. Performance is after fees and before taxes. *From 01 Apr 05; **as at 28 Feb 21. Past performance is not a reliable indicator of future performance.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Find out more about Pendal Focus Australian Share Fund here.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at March 29, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.