Crispin Murray: what’s driving Australian equities this week

Here’s what’s driving Australian equities this week according to Pendal’s head of equities Crispin Murray (pictured above). Reported by portfolio specialist Chris Adams.

The US Federal Reserve hit back last week against the view that they were complacent on inflation.

There was no explicit message on tapering out of the latest meeting of the Fed’s monetary policy arm, the Federal Open Market Committee.

But the “dot plot” of the committee’s rate expectations — and the language in an accompanying statement — were clearly more hawkish than the market expected.

The US yields curve flattened in response. Two and five-year yields rose, while 10-year yields were flat and 30-year yields fell. This also triggered a rally in the US dollar.

In the equity market we saw a sharp rotation out of cyclicals and commodities and into technology. Overall the S&P/ASX 300 was up 0.7% and the S&P 500 was down 1.9%.

Economics and policy

The key point in the Fed release was a shift in the FOMC “dot points” — a chart that outlines interest rate expectations of the 12 FOMC members.

The median view of the committee shifted from zero to two expected hikes by the end of 2023. The three senior committee members are all apparently expecting at least one hike.

The median inflation forecast for 2021 shifted up markedly from about 2.2% to about 3%. This is still considered transitory. Fed chair Jerome Powell noted the recent retracement in the lumber price, for example.

As a result expectations for 2023 CPI remained constant at about 2.1%.

This suggests average inflation will return to where the Fed wants to see it earlier than they previously thought, which explains a shift in the first expected rate hike.

All this should be considered in the context that the Fed has been as inaccurate as anyone else when it comes to forecasting the path of rates, based on its historical predictions versus actual outcome.

There was also a change in the wording of the release, which suggested the tapering decision was no longer more than six months away.

The Fed’s hawkish tone gave the market more confidence that inflation will be contained. Break-even inflation expectations fell, which prompted flattening in the Treasury yield curve.

Yield curve shift

The shift in the yield curve was material, which probably reflects the strength of the consensus position towards inflationary trades.

The debate now is whether this is just an adjustment in signalling or a more significant pivot in the Fed’s stance. Statements this week will be important to watch.

The Fed is unlikely to want any further flattening in the yield curve. So we would not be surprised to see the messaging shift subtlety back to promoting growth.

The US dollar rose along with the short end of the yield curve. This shift in Fed signalling probably means the USD will remain well supported for a period.

This weighed on commodity prices, particularly in crowded trades such as copper, which fell 8.3%. Gold was off 5.8%.

The fundamental supply-and-demand equation remains favourable for commodities. Our medium-term view remains positive, but we may see some near-term weakness as the consensus inflation trade is washed out.

Impact on portfolio construction

This all led to the inevitable rotation towards growth stocks, notably technology.

For the moment the strong rotation from growth to value that began in November looks to have played out.

Instead, in recent months we have seen momentum swing between the two. This emphasises the need to remain balanced in portfolio construction.

We have been adding to our growth exposure in recent weeks to hedge such a policy risk. But we remain underweight more traditional rate sensitives such as REITs.

In commodities we prefer energy to metals at this point. We see fundamentals in energy as a bit more supportive, while it has also been a less crowded trade.

Covid and vaccines outlook

We continue to monitor developments around the Delta variant of Covid, given its potential for larger outbreaks and a higher vaccination threshold for herd immunity.

The UK is the bellwether in this regard. So far a rise in cases has not fed through to higher hospitalisations. This is potentially due to Delta being more benign than the original strain. The level of vaccinations may also be playing a role.

The latest Australian outbreak needs to be monitored, given the slow rollout of vaccines.

The risk of further restrictions has risen. Domestic re-opening trades are struggling to perform in this context. There is a clear divergence from global re-opening exposures. But we are mindful that sentiment can swing quickly in this regard.

Markets

It is important to emphasise that the Fed’s hawkish bent does not mean markets have peaked for this cycle.

First, the broad policy environment remains supportive. We are still looking at two years of near-zero rates and monetary policy has a large lag. Fiscal policy also remains high stimulative.

Second, we can be guided by history. The first hike in a cycle normally prompts a market correction. However the actual peak tends to occur after rates have risen a number of times.

Some speculative excess has been cleared out and the rotation is significant. However equity markets overall seem to have digested the Fed’s shift quite comfortably so far.

US 10-year Treasury yields fell by a basis point last week, while two-year yields rose 11bps to 0.26%.

The divergence between oil and copper is interesting. Copper is off 11.1% for the month while Brent crude is up 6%. Again, this probably reflects consensus positioning in recent months.

The Australian market was dominated last week by thematic rotation. Technology (+12.4%) and Health care (+6.2%) led, while resources dragged down Materials (-4.7%).

Banks (+2.2%) held up reasonably well, in contrast to overseas markets. There may be some near-term vulnerability here.

Gold miners led the underperformers. Northern Star (NST, -13.9%) was the worst in the ASX 100, followed closely by Newcrest (NCM, -8.4%) and Evolution (EVN, -8.1%).

Copper miner Oz Minerals (OZL, -12.2%) also lagged.

Contractor Downer (DOW, -7.2%) also fell, following a broker note which highlighted wage pressure in the contracting space. We do not agree with the conclusion that wage pressure seen in the Pilbara can be applied to expectations for other industries and locations across the country. DOW continued with its stock buy-back, which also suggests this is not the issue some fear it to be.

ResMed (RMD, +12.5%) was the best in the ASX 100. In this case the growth rotation was augmented by news of a product recall from a competitor.

Afterpay (APT, +10.5%) is the most leveraged to the growth trade at the moment. Xero (XRO, +6.1%) also benefited.

A stronger US dollar is beneficial for Ansell (ANN, +9.4%), Cochlear (COH, +4.8%), James Hardie (JHX, +3.6%) and RMD, among others.

Finally, Coles (COL, -1.9%) held a strategy day which flagged that capex will need to rise to compensate for under-investment in recent years. Capex will rise from 2% to more than 3% of sales per year.

This raises questions for the supermarket sector as rising capital intensity may dilute returns. COL also signalled that they are seeing the trend to more neighbourhood style unwinding, although in the current environment we doubt this is material.

About Crispin Murray and Pendal Focus Australian Share Fund

Crispin Murray is Pendal’s Head of Equities. He has more than 27 years of investment experience and leads one of the largest equities teams in Australia.

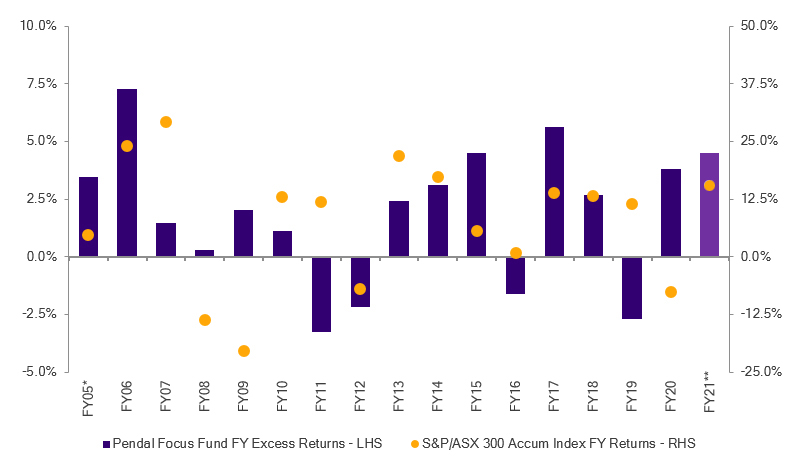

Crispin’s Pendal Focus Australian Share Fund has beaten the benchmark in 12 years of its 16-year history (after fees), across a range of market conditions , as this graph shows:

Source: Pendal. Performance is after fees and before taxes. *From 01 Apr 05; **as at 30 Apr 21. Past performance is not a reliable indicator of future performance.

Pendal is an independent, global investment management business focused on delivering superior investment returns for our clients through active management.

Find out more about Pendal Focus Australian Share Fund here.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at May 31, 2021. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

PFSL is the responsible entity and issuer of units in the Pendal Focus Australian Share Fund (Fund) ARSN: 113 232 812. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling Customer Relations on 1300 346 821 (8am to 6pm Sydney time) or at our website www.pendalgroup.com. You should obtain and consider the PDS before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Performance figures are calculated in accordance with the Financial Services Council (FSC) standards. Performance data (post-fee) assumes reinvestment of distributions and is calculated using exit prices, net of management costs. Performance data (pre-fee) is calculated by adding back management costs to the post-fee performance. Past performance is not a reliable indicator of future performance.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.