A quick dinner in Manila

Infrastructure develops at a glacial pace in Manila. On a short visit, you would hardly notice any meaningful change in this often chaotic city. Bumper-to-bumper traffic, it took us almost 25 minutes to exit the airport and traverse 500 metres across a traffic junction.

Yet there is change. ‘Entertainment City’ houses three of the four newly-built integrated resorts and casinos, the first of which opened in 2013. That whole area is wide open with broad boulevards, a sea-facing frontage and swanky new buildings. A new expressway, completed in 2016, connects the airport to these casinos and has cut travel time to just 20 minutes from more than an hour prior to 2016. It is no wonder that tourism to Manila, in particular from China, has started to pick up, as has the revenue of those casinos. Several large areas that are converted townships are witnessing a boom in property construction. Even outside Metro Manila, in Visayas and Mindanao, there are new roads and airports under construction.

Effective January 2018, Filipinos had a relatively big change in their tax policies. Under the first part of the reform process, income tax for low and mid-level salaried employees was substantially reduced. However, taxes were raised on a host of items, including petroleum products, cars, tobacco and sugar-sweetened beverages. In the next stage, the government wants to reduce corporate taxes from 30% to 25% while simplifying the myriad of incentive schemes given to states.

During a time of rising oil prices and a weakening peso, these changes in taxes are affecting several parts of the economy. For one, costs have increased across the board as petroleum prices have risen. In general, inflation is rising and the pernicious effects are being felt by the most vulnerable and poor sections of society. Companies which cater to the low income part of society, such as Universal Robina, have seen sales slowdown while companies like Robinson Retail, which cater primarily to middle income families, have seen a bump up in sales. The middle-income cohort seems to be in a much better position, especially as they benefit from the income tax reduction. Yet, so far, overall consumption is relatively benign.

We spent a fair bit of time with Jollibee Foods (JFC), the only Philippine stock we currently own in our portfolio. It is a leader in the quick service restaurant (QSR) business in Philippines, with an expanding footprint around the world. If done right, QSR businesses can be very profitable and scalable. American chains such as McDonald’s or Chipotle are prime examples of the model. I’ve seen analysis on QSR models where the EBITDA returns on total investment per store can range from 18-30% pa. In JFC’s case, their main brand Jollibee earns returns per store upwards of 35%.

Over the years, JFC has expanded its offerings of different cuisines in the Philippines. One brand they acquired in 2010, ‘Mang Inasal’, has expanded its store network from 345 to 495 stores in the past seven years. However, by improving sales per store by almost three times, total revenues for that brand increased from Php2.3bn in 2010 to Php17bn in 2017. Once a concept is successful, JFC expands to destinations abroad where there are Filipino nationals.

JFC ventured into China in 2005 and for a long time after that the China business was a struggle. Intense competition, rising wage costs, and lastly a structural shift to online ordering of food have tested its Chinese business. After stagnating for almost three years as management figured out a way to deal with challenges, 2017 has seen a low double-digit same-store-sales growth.

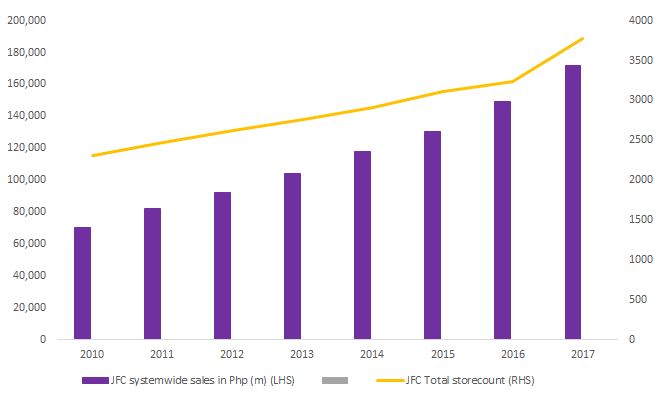

Jolly steady growth at Jollibee Foods

JFC recently took over Smashburger, a burger chain in the US, and increased its existing stake in a company that is expanding in Vietnam to a majority. In the past couple of years, the management team has invested a fair bit, expanding new stores and acquiring new formats. Given their past record of accomplishment, I have reasonable confidence in their ability to execute on this expansion. It is a challenging time for the business: peso depreciation, rising inflation, tax changes and structural changes to the restaurant industry from online food delivery businesses. Yet with a 16% growth in system-wide outlets, a healthy balance sheet and the ability to increase prices and maintain margins over time, JFC should be able to grow through these tough times.

This article has been prepared by Pendal Fund Services Limited (PFSL) ABN 13 161 249 332, AFSL No 431426 and the information contained within is current as at June 13, 2018. It is not to be published, or otherwise made available to any person other than the party to whom it is provided.

PFSL is the responsible entity and issuer of units in the Pendal Asian Share Fund (Fund) ARSN: 087 593 468. A product disclosure statement (PDS) is available for the Fund and can be obtained by calling 1800 813 886 or visiting www.pendalgroup.com. You should obtain and consider the PDS before deciding whether to acquire, continue to hold or dispose of units in the Fund. An investment in the Fund is subject to investment risk, including possible delays in repayment of withdrawal proceeds and loss of income and principal invested.

This article is for general information purposes only, should not be considered as a comprehensive statement on any matter and should not be relied upon as such. It has been prepared without taking into account any recipient’s personal objectives, financial situation or needs. Because of this, recipients should, before acting on this information, consider its appropriateness having regard to their individual objectives, financial situation and needs. This information is not to be regarded as a securities recommendation.

The information in this article may contain material provided by third parties, is given in good faith and has been derived from sources believed to be accurate as at its issue date. While such material is published with necessary permission, and while all reasonable care has been taken to ensure that the information in this article is complete and correct, to the maximum extent permitted by law neither PFSL nor any company in the Pendal group accepts any responsibility or liability for the accuracy or completeness of this information.

Any projections contained in this article are predictive and should not be relied upon when making an investment decision or recommendation. While we have used every effort to ensure that the assumptions on which the projections are based are reasonable, the projections may be based on incorrect assumptions or may not take into account known or unknown risks and uncertainties. The actual results may differ materially from these projections.